A bad bill to rein in insurance adjusters? Proposed California law draws fire

Published in Business News

After the devastating January firestorms left thousands of homeowners to grapple with their insurers over complicated claims for smoke damage and burned-down houses, many turned to public adjusters for help.

The state-licensed professionals play a vital role in assisting policyholders in preparing property claims and representing them in their dealings with insurers.

But a bill sponsored by the Department of Insurance intended to rein in bad actors in the trade is drawing criticism from a leading consumer advocate who says it may actually make it harder for policy holders to get assistance — and discourage them from hiring adjusters.

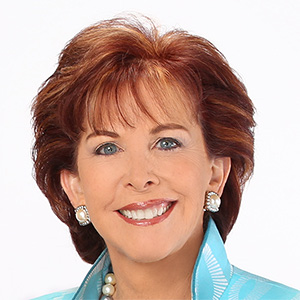

"We want to protect consumers against ripoffs, but they're getting ripped off by their insurance companies as well. So it's really important that it be economically viable for people to hire qualified public adjusters," said Amy Bach, co-founder and executive director of United Policyholders, a prominent San Francisco consumer advocacy group.

In dispute is a bill by Assemblymember John Harabedian, D-Pasadena, whose district includes the Eaton fire zone, that aims to provide additional transparency to public adjuster contracts, including requiring a detailed description of services.

But the proposed legislation, AB 597, includes a provision for contracts signed after a catastrophic disaster — such as the Jan. 7 firestorms — that limits how adjusters can base their compensation, which is often in the form of contingency fees similar to many lawyers.

Currently, adjusters are allowed to base their fees on the total sum of money received by the policyholder for their claim, including any payouts received prior to the signing of contract.

The bill would require public adjusters to set their compensation based only on money received after a contract with an adjuster is signed, which could have the effect of sharply raising their contingency rates. Rates are commonly around 10% or less and might rise to 20% or more as a result of proposed legislation, industry experts say.

Opponents say the higher rates would discourage policyholders from hiring adjusters, potentially reducing the money they could ultimate collect from insurers. They note that major insurance industry trade groups are backing the bill.

"If you want to know how bad this bill is, look at how many insurance industry people support it," said Gregg Clifford, president of Sunpoint Public Adjusters, a Walnut Creek firm that has lead opposition to the bill.

Among the trade groups is the Personal Insurance Federation of California, which represents 12 large property and casualty insurers. It claims current laws allow public adjusters to exploit fire victims and take funds needed for rebuilding.

Other backers include Los Angeles County and the California Association of Realtors.

The state insurance department, which is sponsoring the bill, says the legislation stems from complaints received from policyholders who signed bad contracts with public adjusters that obscure how much money they will have to pay..

"We want to make sure the public adjusters who the department license are being transparent in their contracts when they negotiate contracts with consumers, especially consumers in a disaster area who are under duress," said Tony Cignarale, deputy commissioner of consumer services and market conduct.

Florida and a few other states have similar laws.

Clifford said the proponents of the legislation do not appreciate how many wildfire claims are handled by public adjusters.

Policyholders whose homes have burned down often receive several hundred thousand dollars in advance payments that insurers must provide under state law, often prior to hiring an adjuster. However, in order to get additional compensation, even the initial payouts must be supported by documentation, he said.

That requires adjusters to front tens of thousands of dollars to hire consultants to write building plans, hygienists to test for toxic substances and professionals for other services, he said

"We incur 99% of the costs associated with a claim," said Clifford, who said his firm has signed up more than 150 Jan. 7 fire victims.

The bill passed the Senate Insurance Committee last month and will be heard next week in the Senate Appropriations Committee.

Harabedian, in an interview, defended the proposed fee change and insinuated that Bach was influenced by the president of her board, who is a public adjuster.

"I think that's something to note — draw the conclusions that you'd like there," he said. "No other industry, no other business practice, relies on actually taking money out of people's pockets and making a profit off of that, whether or not you actually get them any new money."

Bach dismissed the criticism as baseless, saying the matter was never brought before her board.

Harabedian's office has pointed to the other consumer support the bill has gained, including from the Eaton Fire Survivors Network, which claims more than 6,000 members and has been a leading critic of how State Farm General, the state's largest home insurer, has handled smoke damage claims.

Joy Chen, chief executive and co-founder of the group, said it supported the bill at the request of Harabedian's office. "While we've not received complaints from survivors on this specific issue, we trust that Assemblymember Harabedian is working with survivors' best interests at heart," she said.

Harabedian's office also referred The Times to Hratch Ghazarian, founder and chief executive of Allied Public Adjusters in Newport Beach. He dropped opposition to the bill, like others in the industry, after a fee cap was removed, but said he understands some of the criticisms.

He said he built his business on contingency fees based on the additional money his adjusters collect for a client. That requires his company to carefully calculate the potential costs of a claim before agreeing to take on the business — and he believes that model promotes transparency and can help clean up the industry.

But he added it is not incorrect to say that after catastrophic losses, insurers will advance payments required by law, requiring public adjusters to justify an entire claim, often in the face of insurer intransigence.

"The public adjuster has to go in there and actually build the claim right, put a value on each respective coverage and what a lot of these carriers are doing is they're just sitting on their hands and stonewalling," said Ghazarian, who said his firm has signed up more than 100 victims of the Jan. 7 fires.

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments