Marked by success, controversy, EV tax credit ends after a 17-year run

Published in Business News

WASHINGTON — The EV tax credit dies today. But its story doesn't necessarily end here.

The $7,500 federal incentive, which had two main iterations over an almost 17-year run, was designed to encourage the production and purchase of electric vehicles in the United States. It expires after the calendar flips past Tuesday thanks to legislation enacted this year by GOP lawmakers and President Donald Trump.

"You were a good patriot, and you lived a tragically short life," Mike Murphy, a Republican strategist who leads an effort to make EVs less political, said of the program. "I'd say goodbye to you in Chinese if I could."

The tax credit was popular and significant in more ways than one. It has been widely adopted to bring down price tags for new and used EVs, and it has been widely debated as a signature policy emblematic of the U.S. auto industry's rocky road to electrification.

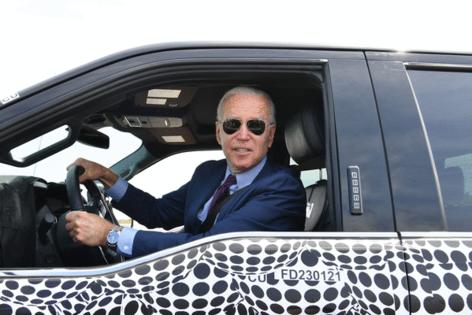

The program was a darling of affluent and eco-minded consumers, elected officials eager to steer the U.S. economy toward greener technologies and some China hawks like Murphy who are wary of the rival nation's dominance in the global EV sector. It was also a target for Republicans eager to dismantle all aspects of what they called an "EV mandate" from former President Joe Biden.

The credit, according to economists and analysts, had its tradeoffs but was ultimately successful in achieving two main goals: Sparking growth in a nascent product category and helping domestic automakers to keep pace with their foreign rivals. Now the industry faces an EV transition — which most experts say is inevitable — without one of its key federal supports.

"I don't think we're going to have a collapse. I'm not that much of a pessimist," Murphy said in a phone interview. "I'm not sure next year will be a growth year like all the past years have been. But if it's negative, I think it'll be low single digits (EV market share), which will then lead to more growth."

The growth Murphy referred to was most significant between the start of the Biden administration in February 2021 and the beginning of 2024, when EV sales figures started to become less consistent. Market share has since hovered around 9% but spiked to an all-time high of 11.5% in August with the impending end of the program.

The federal government expanded tax credits for EVs via the Inflation Reduction Act during the middle of that Biden-era growth window, gaining heightened national attention in the process. But the program's story began more than a decade before.

Credit 1.0: Sparking early growth

There were two main phases of the tax credit, according to Corey Cantor, research director for the Zero Emission Transportation Association. The first began in late 2008 and second began in 2023.

"In its early iteration and form, the credit helped jump-start the kind of EV transition here in the U.S., encouraging more and more consumers to consider electric vehicles," Cantor said.

Lawmakers established the federal EV tax credit — also known as the 30D credit — at the end of the George W. Bush administration amid a deepening collapse of the American auto industry. The program offered a $7,500 credit for the purchase of plug-in electric vehicles.

There was bipartisan support for legislation that led to the program, with the effort led in the U.S. Senate by Sen. Maria Cantwell, D-Washington, then-Sen. Orrin Hatch, R-Utah, and then-Sen. Barack Obama, D-Illinois. The credit was folded into a larger clean energy tax incentive package that passed the chamber with overwhelming bipartisan support in October 2008.

That version of the credit, after a legislative tweak in 2009, had a 200,000-vehicle cap for eligibility. Automakers making forays into electrification like Tesla Inc., General Motors Co. and Nissan Motor Corp. could benefit from the incentive only while establishing a foothold with their electrified offerings.

The results — and resulting taxpayer costs — were not immediate. The nonpartisan Congressional Budget Office wrote in a September 2012 report that "no manufacturer is near the threshold at which the tax credits will begin to be phased out." Then-President Obama at one point that year proposed raising the credit to $10,000.

EV momentum developed over time, though, and research points to the tax credit playing an important role. One study from 2016, which surveyed about 2,900 plug-in vehicle owners, attributed "more than 30% of the (EV) sales to the federal tax credit, with an impact of up to 49% for the Nissan LEAF."

GM and Tesla were first to hit the ceiling in 2018, triggering a phase-out process that saw the number of tax credits they could offer falling by half every six months until they hit zero. GM found success with the Chevrolet Volt, and Tesla began building its dominance of the U.S. electric vehicle market with the Roadster and Model S.

Ford Motor Co. and Toyota Motor Corp. also eventually hit the credit limit, according to the Internal Revenue Service.

By the end of 2018, plug-in models accounted for 2% of U.S. new vehicle market share for the first time and brought renewed scrutiny to the credit originally designed to foster early growth. GM and Tesla called on Congress to lift the 200,000 cap, and many lawmakers agreed with their position.

Democrats in Congress introduced a bill to remove the cap. So did Republican then-U.S. Sen. Dean Heller of Nevada, where Tesla has a major presence. Meanwhile, U.S. Sen. John Barrasso of Wyoming, now the No. 2 Republican in the chamber, introduced legislation to terminate the credit.

"The electric vehicle tax credit largely benefits the wealthiest Americans and costs taxpayers billions of dollars,” Barrasso said at the time. “My legislation levels the playing field for all drivers across America."

Credit 2.0: Pushing U.S. manufacturers

Supporters of the EV credit won out in the summer of 2022 when Biden and his allies in Congress lifted the cap and set the credit to expire in 2032, though there were new strings attached meant to promote U.S. manufacturing. The expanded incentive succeeded at doing just that, according to economists and analysts.

"The way the credits were constructed really did have an eye specifically towards not just enhancing EV adoption in the U.S. market, but specifically enhancing the adoption of EVs made in the United States," economist Reigner Kane said in a phone interview. Kane was one of five co-authors on an October 2024 working paper examining the expanded tax credit.

Kane continued: "And that does seem to be something, according to our estimates, that the IRA did fairly well at. A lot of the benefits, in terms of additional EVs added to the market, were really coming from these domestic firms — so Tesla, GM, Ford, etc. — and relatively few from foreign firms."

The Biden administration restructured the credit by splitting it into two parts worth $3,750 each: One for critical minerals sourcing and the other for battery component sourcing, with domestic content requirements getting stricter over time. The administration also required that final vehicle assembly take place in North America for a car or truck to be eligible and set an income cap for buyers — albeit with a big loophole.

Beyond the headline-grabbing 30D credit, the government created an additional $4,000 tax credit for used EVs and another for qualified commercial vehicles, both of which also disappear after Tuesday.

The tax credits boosted new EV registrations by 300,000 in 2023, according to the October study. The researchers estimated that domestic brands sold about 835,000 EVs that year, but would have sold only 525,000 without the credit. That represents a nearly 60% jump.

Foreign firms, by contrast, enjoyed a much smaller boost of about 7,000 units from the credits. They would have sold between 340,000 and 350,000 EVs regardless.

The study also estimated that the credit caused a roughly 3 percentage point increase (8.3% to 11.2%) in EV market share and a 10-point jump (59.9% to 70.5%) in the percentage of U.S.-sold EVs that were assembled domestically.

Those numbers indicate that the Biden administration's expanded version of the EV credits did what the former president and his allies hoped, though critics like Barrasso and Senate Majority Leader John Thune, R-S.D., have called out the multibillion-dollar price tag to achieve those results.

Republicans' move to repeal the EV credits through their One Big Beautiful Bill Act will save the federal government about $189.7 billion over the next decade, according to the Congressional Budget Office.

"The hard-earned money of taxpaying Americans should not cover the cost for the luxuries of the nation’s elite," Barrasso said in a February statement after again introducing legislation to end the credits. “Repealing these reckless tax credits from the Biden administration once and for all will stop Washington from giving handouts to our adversaries and high-income individuals."

His statement was a reference to the fact that EVs are more popular with affluent consumers and that a critical loophole in the credits allowed buyers and automakers to get a $7,500 boost on leased vehicles without any of the income or domestic sourcing restrictions.

The impact of that loophole was significant. That policy design resulted in a 17-point jump (12.2% to 29.3%) in the share of new EVs that were leased rather than purchased, according to Kane and the other researchers.

Murphy, the Republican strategist, said the Biden administration was certainly aware of the loophole. But he guessed that officials decided not to patch it because leases — especially given many buyers' hesitance to commit to a new and unfamiliar powertrain — have become a driver of EV adoption. They also have the power to create longer-term impacts on the market than outright purchases.

"I'm very curious to see how the leasing provision is going to affect the used vehicle market in the next few years," said economist Max Maydanchik, one of the October study's co-authors. He pointed out that the U.S. used vehicle market (about 37.4 million units last year) is significantly larger than the new vehicle market (about 16 million).

"The typical lease term is about three years, and a lot of those leased vehicles are going to enter the used vehicle market," Maydanchik said. "Maybe used vehicles that are cheaper are going to be the entry point for a lot of people into EVs."

For that reason, he said the full story of the EV tax credits is "not yet written."

Roll credits: What comes next

Republicans' sweeping election wins last November quickly created a difficult political environment for federal EV support, even as a short-lived bromance between Tesla CEO Elon Musk and Trump provided some hope for the credits and other programs.

In the new environment, Murphy explained, automakers shifted priorities to issues that better aligned with GOP leaders: "They did do some lobbying for (EV supports). You know, they called up and said, 'We think this is really important. And by the way, we want to save our subsidy for our specific plant.' But did they really go to war? They did not.

"Their theory was: 'We're going to get the fuel economy standards lifted and we're not going to have to pay Elon billions of dollars a year in carbon credits. We'd love to keep the credit because we're losing money on EVs, we don't want to piss off Trump on the other stuff.' This was nothing like the kind of full-scale push they're capable of putting on. And I think that was a choice."

Automakers, especially without stringent Biden-era emissions targets, can now transition to electric vehicles at a more comfortable pace. Several have shown signs of doing just that by scrapping or delaying certain electrified product offerings while still committing to long-term EV manufacturing projects. Many of those projects will rely on the separate federal 45X tax credit — which survived the Trump transition — for production of EV batteries.

In the very short term, demand for electric vehicles has spiked to record levels in the dying days of the EV credits. However, analysts widely expect a lull without those financial incentives.

"Growth moving forward will be slower than many advocates hoped, though continued innovation in battery technology, improved transparency in battery health and expanding infrastructure give reason for optimism. The road ahead will be challenging, but progress will continue," Stephanie Valdez Streaty, director of industry insights for Cox Automotive, wrote in a Sept. 23 blog post.

Cantor, the ZETA research director, pointed to Germany and the United Kingdom for reference points on what might happen in the U.S. market. Both countries ended their national EV credits in recent years, though the U.K. restarted a similar program in July.

"You basically see a correction in the quarter following, weaker demand than you otherwise would have seen. And then it takes a couple of quarters to get back on the growth track," he said of those examples. Cantor also pointed to some places in the United States, like Colorado, that will help buoy EV sales with existing state-level credits.

Dealers around the country, in touch with their automakers and heeding industry predictions, said they are riding out the EV sales highs while preparing for a slowdown.

"We're a little bit nervous because we're not sure exactly how it's going to work out," said Walt Tutak, the dealer trade inventory manager at Matthews-Hargreaves Chevrolet in Royal Oak.

"We're watching the inventories. We don't want to go crazy trying to sell them now, because there's still going to be a market for (EVs). But we're sort of playing it by ear because we're waiting to see whether GM is gonna slow down production on anything," he added.

Tutak said his dealership usually sells about 90% traditional-gas powered vehicles and 10% plug-ins, but that split has looked more like 70/30 over the last two months. The dealer manager also noted that around 80% of the electric models driven off the lot recently have been leased.

Tutak predicted that "we're going to probably see a decrease in sales, but it's not going to be as big as some people think." He added that "there's a lot of two-year leases out there. And people really enjoy these EVs, so I think they're going to stick with them." His top-selling EV models have been the Chevy Blazer and Equinox.

Scott Gruwel, president and CEO of Courtesy Automotive Group, painted a similar picture in discussing dealerships for nine different car and truck brands near Phoenix and San Diego.

"We are seeing an uptick in leads, and we are doing a good job of selling this last week and a half — definitely more than normal. But people aren't coming and blowing down the doors and waiting in lines to try to take advantage of this EV tax credit," he said.

Gruwel noted that the Phoenix market typically does not have high lease penetration, but "astoundingly good" deals meant to offload EVs have caused leases to double above usual levels. "The idea is to not have too much inventory when this thing goes away," he said.

"But we still anticipate having EVs to stock and to sell, and I support that. It might not be as much of a focus, but it's still a part of the game plan," Gruwel added. "It's not like everything drops off a cliff."

Jim Walen, who owns and operates Stellantis and Hyundai Motor Corp. dealerships in Seattle, said he had mixed feelings about the end of the EV credits.

Walen did not like that the credits largely went to "rich people" who could already afford more expensive electric vehicles. He was also frustrated that exclusive EV-makers like Tesla and Rivian Automotive Inc. were eligible for the credits while also collecting, in Tesla's case, "billions and billions of dollars" from emissions credits sold to other automakers.

However, Walen also lamented that losing the $7,500 credit would slow industry progress toward making EVs accessible and "depress sales" at a time when the car business has already been "under assault by the Trump administration from Day One" via tariff policies.

"I'm the largest volume Hyundai dealer in the state of Washington, as well as the largest by retail volume for Stellantis," he said. "My job is to deliver affordable transportation to the masses. And I will say that, overall, this is going to hurt us."

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments