Cryptocurrency ATMs in gas stations, grocery stores are magnets for fraud

Published in Business News

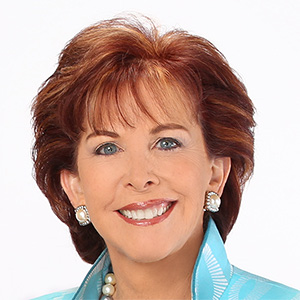

MINNEAPOLIS — Last year, Mellissa McKie wired Isanti County Sheriff’s Sgt. Tom Leatham as much money as she could get her hands on in a day.

She thought paying $2,000 through cryptocurrency kiosks, in a gas station and at a currency exchange, would satisfy two arrest warrants issued for failing to appear in court as a juror in a federal murder trial, sparing her a three-week stint in jail.

But it turned out there was no case against her. No warrant. No Sgt. Leatham. It was all a scam, designed to play on her own fears and emotions to coerce her into depositing thousands of dollars into a cryptocurrency ATM — money she would never see again.

The crypto ATM is fast becoming the hottest tech tool in elaborate fraud schemes that many local police departments are unequipped to solve. The machines resemble traditional ATMs, but instead of dispensing cash, most only allow users to put cash in for the purpose of buying cryptocurrency, like Bitcoin, on an exchange.

The machines, often placed in gas stations, liquor stores and supermarkets, allow fraudsters to convince people like McKie to deposit cash into internet-based cryptocurrency accounts outside traditional banks, making the money nearly impossible to trace or recover.

Desperate to stop eye-watering financial losses, which topped $200 million last year nationwide, state and local officials have taken steps to regulate or even ban the cryptocurrency kiosks themselves to stem the tide of financial fraud.

The Minnesota Legislature adopted new requirements for the machines last year. Brooklyn Park, Forest Lake, St. Paul and Stillwater are all among cities where patterns of fraud are prompting leaders to consider regulating cryptocurrency kiosks at the local level.

Stillwater banned the machines in April, drawing a lawsuit from industry leader Bitcoin Depot, which claims to be the nation’s biggest cryptocurrency machine operator. The Atlanta-based company has more than 8,500 machines spread across in the U.S.

Skeptical government officials question why cryptocurrency kiosks need to exist, given that savvy users can buy cryptocurrency through cheaper, more convenient means, like on a smartphone app or a home computer.

“I’ve yet to find anybody that’s made a legitimate investment in crypto via a kiosk at a gas station or a liquor store,” said Stillwater Mayor Ted Kozlowski, adding no one other than the kiosk operators stepped up in defense of the machines before the city banned them in April.

Operators say fraud accounts for a small number of transactions at their kiosks, and they work to prevent frauds through education, on-screen warnings, identification verifications and other security controls.

Attorneys general in Iowa and Washington, D.C., recently sued three large operators — Bitcoin Depot, CoinFlip and Athena Bitcoin — alleging more than 90% of their transactions are fraud-based. The companies dispute that estimate.

Skyrocketing nationally

Despite the concerns, reported use of cryptocurrency kiosks is growing at a rapid clip.

Across the nation, scam victims lost $246.7 million to frauds involving cryptocurrency kiosks last year alone, according to the FBI’s latest Internet Crime Report. That represented a 31% increase compared to 2023.

The Federal Trade Commission likewise found a skyrocketing increase last year in the use of the ATMs to fund fraud, based on an analysis of consumer reports. And the U.S. Treasury’s Financial Crimes Enforcement Network warned in August of cryptocurrency kiosks being used in scams as well as money laundering for major drug cartels.

In Minnesota, state lawmakers enacted requirements last year, including a $2,000 transaction cap for new customers, a pathway for defrauded consumers to get full refunds, and updated regulatory oversight under the Department of Commerce.

Criminals, though, routinely outfox those safeguards, according to local police and city officials. A loophole in Minnesota’s law also allows cryptocurrency kiosk companies to deny fraud victims refunds.

Meanwhile, most of the state’s cryptocurrency kiosks are run by companies that have failed to abide by Minnesota’s latest operating regulations.

The Minnesota Commerce Department this year fined eight cryptocurrency operators — with the fines ranging from $5,168 to $10,337 — for transmitting money without a proper license in violation of state law. The steepest fine went to Bitcoin Depot, which appears to own roughly 25% of Minnesota’s machines.

Bitcoin Depot said it now complies with state requirements. The company, which started operating in Minnesota in 2019 and maintains 111 cryptocurrency kiosks in the state, obtained its license five months ago, according to court records.

Cities crack down

Stillwater’s ban of the machines came after detectives admitted they were “getting smoked” on investigations involving cryptocurrency kiosks, Stillwater Police Chief Brian Mueller said.

One fraud was so convincing, police officers had trouble stopping a 75-year-old woman from putting large sums of money into a machine.

“We had to physically stand there between her and the machine,” Mueller said.

In 2021, Stillwater police recorded a single cryptocurrency kiosk scam with a $760 loss. By 2024, the annual loss grew to $90,940. The machines played a central role in 70% of the city’s cryptocurrency-related cases.

“It was staggering,” said Kozlowski, the city’s mayor.

Bitcoin Depot’s lawsuit against the city of 19,000 seeks to undo the ban. The company said in a statement the lawsuit is about “protecting Minnesotans’ access” to cryptocurrency kiosks. It described its machines as “safe and regulated.”

Forest Lake, which recorded about $300,000 in cryptocurrency kiosk-related fraud between 2023 and 2024, decided in April to add a $2,000 annual registration fee for hosting the machines.

Police conduct regular compliance checks, and machines must remain under constant video surveillance. Host businesses might lose the privilege to keep a cryptocurrency kiosk on the premises if multiple substantiated instances of fraud unfold at the same location, the regulation says.

Forest Lake Police Det. Nathan Olstad said his town has seen no new cases since it took effect. Business owners chose to turn the machines off or get rid of them.

Consumer protections falling short

In one of the last Forest Lake fraud cases in December, a man deposited $19,500 into a Bitcoin Depot ATM at a Holiday gas station. He received a partial refund, though was denied a full one sought under the state’s “new customer” rule, according to a police report.

An Edina man lost $14,900 to an imposter scam, where a person posed as an Apple support employee, and could not get a full refund from Bitcoin Depot, which defeated his claim in court.

McKie, the Isanti victim, never learned how much CoinFlip collected on her transactions. Neither kiosk she used printed a receipt, which she remembers clearly because the scammer wanted one. She took pictures of the machine’s screen to document her transactions instead.

McKie thought the process for reclaiming her lost money was too much to handle. A friend at work helped her set up an online fundraiser last year to raise the $2,000 she lost.

Though state law establishes that a Minnesotan considered a “new customer” is entitled to a full refund when swindled at a cryptocurrency kiosk, local authorities who spoke to the Minnesota Star Tribune said cryptocurrency kiosk operators are exploiting a loophole to avoid paying refunds. Because scammers typically send victims information, like a QR code, to access a scammers’ account directly, many victims do not set up accounts and are therefore not considered “new customers.”

One Minnesotan, who spoke to the Star Tribune on the condition of anonymity for fear of becoming a scam victim again, received refunds from Athena Bitcoin and another operator called RockItCoin. He said Athena Bitcoin at first told him he was out of luck but later made him whole. Meticulous record keeping likely helped his case, he said.

Some authorities allege cryptocurrency operators intentionally make their fees difficult to understand. Earlier this year, Iowa Attorney General Brenna Bird sued Bitcoin Depot and CoinFlip, accusing the companies of introducing several confusing steps a customer needs to follow to learn how much a kiosk operator charges.

For example, to calculate Bitcoin Depot’s take, a user needs to multiply the market price of Bitcoin by the amount of cryptocurrency sent to determine its cash value; subtract that figure from the total amount of cash put into the machine; and figure in a nominal $3 flat fee. In the case of an $8,800 transaction, the Iowa attorney general calculated a $2,038.27 fee.

Using fear to drive a scam

McKie recognizes in hindsight she could have escaped the ordeal quickly and without financial loss. Had her husband been home, she said, he would have convinced her the call was a con. Today, she is more cautious about answering her phone and just recently hung up on a scammer who tried to run a different scheme on her.

She felt like she was being manipulated and “held captive” emotionally when she dealt with the man she thought worked for the Isanti County Sheriff’s Office. The con was designed to isolate her and exploit her fear of being locked in a jail cell, away from her husband and kids. Having never been in trouble with the law before, she said, it all seemed real enough to her.

It took McKie calling her father to ask for more money — with the scammer listening on the line through a three-way call, monitoring to ensure McKie complied with a fake judge’s “gag order” — before she got help. Worried for her safety, her dad arranged for police to meet her at a gas station.

McKie said the fraudster stayed on the line and pretended to be law enforcement even as a squad car pulled up next to her.

“He played it all the way up until the cop took the phone from me,” she said.

©2025 The Minnesota Star Tribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments