How GM is preparing for an economic downturn

Published in Business News

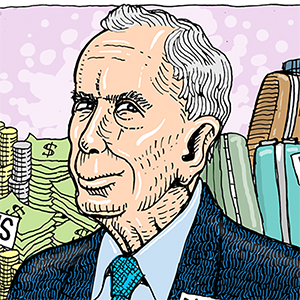

General Motors Co. is strategizing for an inevitable economic downturn by paring down dealer inventory and maintaining a cash safety net, Chief Financial Officer Paul Jacobson said Wednesday.

Jacobson's comments to a panel of auto insiders at the Chicago Federal Reserve Bank's Detroit branch provide insight into industry leaders' expectations for the broader economy, as well as reassurance that the Detroit company is taking steps to remain resilient in tougher times.

"We're going to see a weak economy at some point. I hope it's not this year, hope it's not the year after that. But it's coming," Jacobson said. "We can't dodge economic cycles, but what we can do is try to minimize the self-imposed cyclicality that we've seen in the industry."

Part of GM's plan hinges on controlling the number of vehicles its dealers have on hand.

In the past, Jacobson said automakers typically ensured that dealers had four-to-six months worth of models on their lots. But that creates problems, he said, when sudden shocks to the economy dry up demand, forcing automakers to offer steep discounts.

The ebb and flow of ramped-up production followed by discounts during low-demand periods "really hampered and hindered the business," Jacobson said.

"Because we were chasing demand with lower prices at the same time we needed that cash flow to be able to invest in the future," he said.

Jacobson said GM ended 2025 with an average 48-day supply at its dealers and aims to keep supply around 50 to 60 days.

"When the inevitable downturn or recession or weakness might hit, we're going to be able to respond much, much faster because we're going to be focused on the business forward, rather than trying to undo some of the inventory that we had built up over time," Jacobson said.

The second part of GM's plan centers on what's called free cash flow, meaning taking in more money than the company is spending at any given time. Jacobson said GM historically has had about $3 billion in excess cash flow. Now, free cash flow is closer to $10 billion, he said.

"That's important because that's our cushion," Jacobson said. "That's our safety blanket so we can absorb short-term shocks to demand."

©2026 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments