Jill On Money: Managing money amid uncertainty

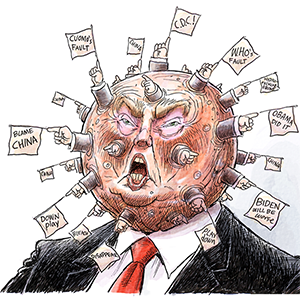

If there is one word that keeps popping up when it comes to the economy and to markets, it is uncertainty.

Maybe the job market will be OK, but maybe it won’t; maybe the economy can withstand tariffs or maybe we will slow down and slide into a recession; maybe AI will eliminate all of our jobs, but maybe it won’t; and maybe the stock market will tumble into a bear market (a drop of more than 20 percent from recent highs), or maybe it won’t.

All of this uncertainty is hard to manage. When feeling overwhelmed by the news cycle, it’s great to talk to wise folks, who have seen a lot in their lives and careers.

As luck would have it, I recently interviewed David Booth, the founder of Dimensional Fund Advisors and the namesake of the University of Chicago Booth School of Business.

The story of how Booth and an unlikely cast of academic upstarts at the University of Chicago in the 1960s transformed the investment landscape and created modern finance is chronicled in a new documentary called Tune Out the Noise that you can watch on YouTube.

In our interview, Booth said something striking: “Investing has a lot of similarities to life in general. Investing is complex and uncertain, so’s life... you make the best decision based on your circumstances and the information you have.”

With uncertainty swirling about, the best bet is to tune out the noise and concentrate on what we can control. To that end, I returned to my handy Panic Protection Plan that I update periodically. This step-by-step process can help calm your nerves and keep you on track with your financial goals.

(1) Make sure that you have 6 to 12 months of living expenses in an emergency reserve fund.

(2) Pay down outstanding high interest consumer loans.

(3) Maximize retirement contributions, to the best of your ability.

Do you need to make a house down payment, purchase a car or pay a tuition bill within the next 12 months? If so, make sure that it is not invested in anything that can fluctuate (stocks, bonds, crypto) and instead, keep it in a safe savings, checking or money market account.

Most of us are saving for a long-term goal, which is likely years or decades in the future. Even if you are retiring within the next couple of years, your account needs to last another 20-30 years. Considering your time horizon can help you endure painful drops in markets and in your investment accounts.

Instead of obsessing over market ups and downs, figure out how much you are paying in investment fees and determine if you can scoop up some free money.

Can you replace an actively managed fund with a no-commission index fund? How much are you paying a so-called advisor? Could you replace them with an automatic investment platform at a fraction of the cost? Find that free money!

There are plenty of people who can manage their own financial lives, but others can really be their own worst enemies and make classic market timing mistakes, which leads them to buy high and sell low.

If you are hiring a pro, make sure that you know what services you are paying for; how your advisor is compensated; and be sure that they adhere to the fiduciary standard, meaning he or she is required to act in your best interest.

To find a fiduciary advisor, go to NAPFA.org, LetsMakeAPlan.org, or AICPA.org.

_____

_____

========

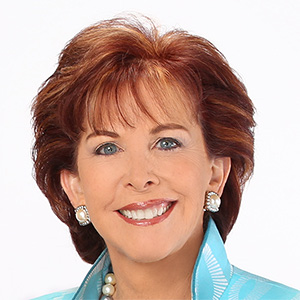

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2025 Tribune Content Agency, LLC

Comments