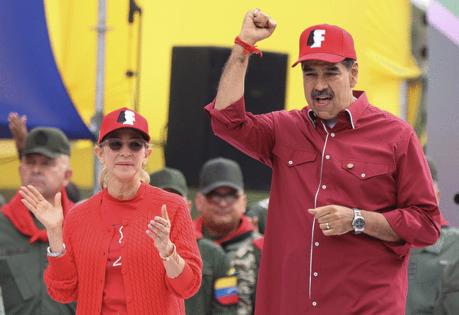

Maduro remains defiant despite Venezuela's dire economy and Trump's tariff threats

Published in News & Features

As fresh rounds of U.S. sanctions begin to affect Venezuela’s economy, the government in Caracas has been trying to reassure citizens that the country remains resilient against Washington’s pressure. President Nicolás Maduro and his officials insist that Venezuela can withstand any economic measures imposed by the United States, dismissing concerns over the country’s financial stability.

However, its currency markets tell a different story.

The Dólar Paralelo, Venezuela’s black-market exchange rate, continued its steep decline this week, with the national currency plunging past the 105 bolívar-per-dollar mark. That represents a widening gap with the official exchange rate, which stands at 69 bolívars per dollar. The bolívar has lost 50% of its value since the days leading up to Donald Trump’s presidential inauguration, with a significant portion of that decline occurring this week after the U.S. administration announced a 25% tariff on countries purchasing Venezuelan oil and gas products.

Speaking on national television Wednesday, Maduro denounced the sanctions as an attack on Venezuela’s sovereignty.

“Any disruption they create, like those they have created in the past, will be confronted and neutralized so we can continue on our path,” Maduro said. “Venezuela’s destiny must be ultimate social happiness with independence, sovereignty, democracy and freedom.”

Maduro has labeled the new tariffs “arbitrary, illegal and desperate,” vowing to implement an economic strategy to counteract their impact. Other officials have echoed his defiant stance, including Interior Minister Diosdado Cabello, who sought to downplay concerns during his television talk show "Con el Mazo Dando" — "Hitting With the Club."

“Sanctions and threats from the U.S. government will not subdue the people of Venezuela. Those who believe they will defeat us with a sanction or a threat should review history,” Cabello said. “We hear threats from the United States, Guyana, the European Union, and some organizations that declare Venezuelans enemies. Our response has always been measured. We have not lost hope at all; we have nerves of steel, calm, and prudence.”

President Donald Trump announced Monday that the U.S. will impose a 25% tariff on imports from any country that buys oil products from Venezuela, saying he is penalizing Caracas’ socialist regime for deliberately sending tens of thousands of criminals to the U.S. The tariff will take effect on April 2.

Experts say the tariff may cause several international energy companies still operating in Venezuela to reconsider.

These companies include Spain’s Repsol, Italy’s Eni, France’s Etablissements Maurel & Prom and India’s Reliance Industries. Along with Texas-based Chevron, which is already in the process of withdrawing from the country, those firms account for nearly half of Venezuela’s 900,000 barrels-per-day oil production.

Analysts also believe that the tariff will affect Venezuelan oil exports to China. Caracas has been sending approximately 200,000 barrels per day to China as repayment for massive debts accumulated over the years with the Chinese government.

Despite government reassurances, financial analysts warn that the sharp depreciation of the bolívar signals widespread economic anxiety. Economists caution that if the currency’s decline continues, Venezuela could once again enter a period of runaway inflation, potentially reaching the threshold of hyperinflation that devastated the economy in previous years.

The newly imposed U.S. tariffs are already affecting Venezuela’s oil industry, as key buyers reconsider their purchases to avoid the financial penalties.

Analysts predict that this could result in a $5 billion shortfall in oil revenues for Venezuela in 2025, exacerbating the country’s chronic shortage of hard currency. With dwindling foreign reserves and restricted access to global financial markets, the South American country’s economic outlook remains precarious.

_____

©2025 Miami Herald. Visit miamiherald.com. Distributed by Tribune Content Agency, LLC.

Comments