US eyes post-war business with Russia in energy, metals

Published in News & Features

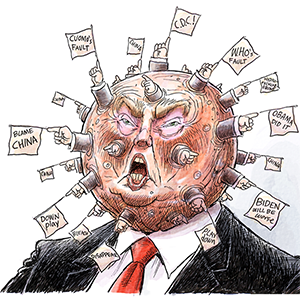

The Trump administration is looking at cooperation in the Russian energy sector as a key element of economic enticements to win over the Kremlin as it pushes for a deal to end the war in Ukraine, according to people familiar with the planning.

Joint projects in the Arctic, as well as oil and gas and rare-earth minerals, are among the options being considered under a partnership the U.S. would offer as part of a peace pact, the people said, asking not to be identified discussing matters that aren’t public.

Russia, encouraged by President Donald Trump’s talk of economic deals that could follow a peace agreement, is drawing up a list of projects and assets that officials hope might interest the U.S., according to people in Moscow involved in the effort. The ideas are collected by Kirill Dmitriev, President Vladimir Putin’s envoy for economic relations, who’s become a key conduit to the White House.

The two sides aren’t discussing plans directly at the moment, the people said. Any effort to rekindle economic ties would face enormous hurdles, from the thousands of sanctions still in place on Russia from the U.S. and its Group of Seven allies to the Kremlin’s long-standing reluctance to allow foreign investors control in strategic sectors like energy.

The focus on possible business deals, especially in the energy sector, highlights the Trump administration’s transactional approach to foreign policy. If the agreements are realized, they could also leave U.S. companies with a major role in the flow of gas, oil and electricity from Russia and Ukraine, including to Europe.

The effort follows on the heels of Trump’s push for a comprehensive investment agreement with Ukraine that would give the U.S. a major role in projects to exploit the country’s mineral deposits and rebuild its infrastructure.

The U.S. is driving for a quicker peace accord and has threatened to walk away from negotiations if the parties won’t agree to halt the hostilities. The U.S. will demand that Russia accept Ukraine’s right to develop its own adequately equipped army and defense industry as part of a peace agreement, people said earlier this week, while Ukraine may be expected to give up some territory.

U.S. envoy Steve Witkoff met with Putin in Moscow Friday for talks that the Kremlin described as constructive. Dmitriev participated in the meeting, according to state media.

“The way that Trump likes to frame politics is in reference points that he can understand like business, and for now the Russians are happy to go along with this,” said Emily Ferris, a senior research fellow in the International Security Studies department at the Royal United Services Institute in London.

The U.S. proposed lifting sanctions on Moscow as part of any peace deal, according to people familiar with the situation, though that would also require agreement with the European Union as many of the most stringent restrictions have been imposed by the bloc.

The U.S. sees economic incentives as a key element in persuading Putin in the drive for peace, according to the people.

“We do not confirm or deny details of ongoing negotiations. When the president has something to announce, we will announce it,” White House spokesman James Hewitt said in response to a request for comment for this article.

On Wednesday, Secretary of State Marco Rubio denied a report he and Witkoff had discussed lifting energy sanctions.

Trump posted on social media April 20 that if Russia and Ukraine reach a deal, “BOTH WILL THEN START TO DO BIG BUSINESS WITH THE UNITED STATES OF AMERICA.”

Some Russian officials are hopeful they can establish an economic partnership with the U.S. even if talks over ending the fighting in Ukraine collapse, one of the people close to the Kremlin said.

Kremlin spokesman Dmitry Peskov didn’t respond to a request for comment. Dmitriev’s office declined for comment.

“Russia’s trade with China is currently about 70-fold larger than its trade with the U.S., so that naturally limits the available options,” said Maria Snegovaya, senior fellow at the Washington-based Center for Strategic and International Studies. Still, the White House could adopt a more flexible approach to sanctions enforcement, potentially allowing U.S. energy companies to secure meaningful stakes in Russian energy ventures, including in the Arctic, she said.

One U.S. proposal would see American control of Ukraine’s Zaporizhzhia Nuclear Power Plant, which is now under Russian occupation, with the electricity output sent to both countries, the people said. Ukraine indicated that such an option at Europe’s biggest nuclear plant would come with numerous issues.

“If the U.S. enters a format of managing this station, they will only be able to do so with the help of our technical personnel. Immediately, questions arise about access to water, infrastructure and security,” Ukrainian President Volodymyr Zelenskyy said earlier this week. It would be more acceptable if Ukraine and the U.S. controlled the plant, though that option isn’t on the table, according to him.

The U.S. has also discussed ways that the participation of American investors, either in production or transportation assets, might help restore some of Russia’s energy exports to Europe. The continent was Moscow’s largest market before the Kremlin’s February 2022 full-scale invasion of Ukraine but has since slashed its dependence on Russian supplies.

The U.S. has indicated an interest in working with Russia on projects in the Arctic and cooperating with energy giant Gazprom PJSC, although those contacts were not on an official level, Bloomberg reported in March. It has also informally explored the possibility of working with Russia to resume natural gas deliveries to Europe that were halted by Ukraine this year, two people said. That’s especially complicated as many states diversified supplies away from Russia following the invasion of Ukraine and the EU is working on a roadmap to phase out Russian fossil fuels.

The idea of allowing U.S. companies to get access to Russian energy or transport assets has been discussed internally in Moscow, said a top executive of one state entity working with Gazprom and Rosneft PJSC. Selling stakes in energy projects or companies to the Americans, ideally those close to Trump, could be strategically useful, as it may ease the sales and cross border payment processes, he said, adding that he’s expressing a personal view.

It’s unclear which American companies could be involved in investments in the Russian energy sector and past relationships have been bumpy. The U.S. itself is also competing with Russia for the European LNG market.

The U.S. wasn’t among Russia’s top 10 biggest foreign direct investors before the war in Ukraine. American business in Russia was driven by brands ranging from McDonald’s Corp and PepsiCo Inc to the Ford Motor Co, while its presence in the energy and commodities sectors was less visible.

There were also big losses after the invasion of Ukraine. Exxon Mobil Corp eventually lost the Sakhalin-1 oil and gas project as Putin signed a decree to transfer operations to a Russian entity.

Putin has also offered Russia’s rare-earth deposits, following Trump’s repeated public expressions of interest in the critical minerals.

The Tomtor deposit in Yakutia in Russia’s far east is one potential candidate for cooperation with the U.S., one of the people close to the Russian government said. The deposit, one of the word’s biggest, in particular in niobium, is owned by former managers of the ICT Group since the Russian invasion of Ukraine, and development was paused as sanctions prevented access to needed technologies.

American involvement in the project may help to resolve the issue as some sanctions could be eased, according to a person familiar with the situation. The deposit’s current owners weren’t available to comment.

Putin in November ordered to ensure the development of Tomtor either by its owners or with help from other investors or the state.

To be sure, even if a peace accord is reached to end the war in Ukraine, there’ll be a lot of political and economic uncertainty over the outlook for long-term investments in Russia.

“Many American companies lost a lot in Russia since 2014,” said Alexander Gabuev, director of the Carnegie Russia Eurasia Center. “Any significant influx of investors from the U.S. is a utopia.”

(Volodymyr Verbianyi, Jennifer A. Dlouhy and Natalia Drozdiak contributed to this report.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments