Nvidia eases concerns about China with upbeat sales forecast

Published in News & Features

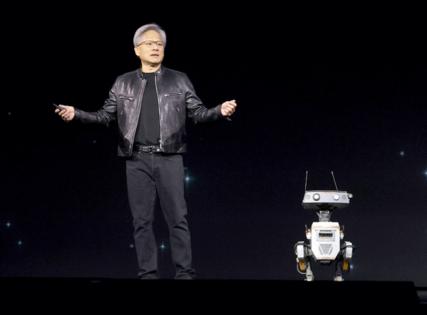

Nvidia Corp. Chief Executive Officer Jensen Huang soothed investor fears about a China slowdown by delivering a solid sales forecast, saying that the AI computing market is still poised for “exponential growth.”

The company expects revenue of about $45 billion in the second fiscal quarter, which runs through July. New export restrictions will cost Nvidia about $8 billion in Chinese revenue during the period, but the forecast still met analysts’ estimates. That helped propel the shares about 4% Wednesday in extended trading.

The outlook shows that Nvidia is ramping up production of Blackwell, its latest semiconductor design. The chipmaker — now the world’s largest by revenue and market value — dominates the field of AI accelerators, the components that help develop and run artificial intelligence models. And an ever-broader lineup of hardware and software is letting Nvidia sell more products to customers.

As part of that push, the company is offering its chips as part of whole computer systems — a move it says is necessary to speed up the deployment of more complex and powerful technology. Nvidia expects AI infrastructure to eventually transform economies around the world.

“Every nation now sees AI as core to the next industrial revolution — a new industry that produces intelligence and essential infrastructure for every economy,” Huang said on a conference call with analysts.

Nvidia shares had earlier closed at $134.81 in New York, leaving the stock little changed in 2025.

Sales in the first quarter, which ended April 27, rose 69% to $44.1 billion. That compared with an average estimate of $43.3 billion.

That growth would be enviable for most chipmakers, though it was the smallest percentage gain in two years. Profit was 96 cents a share, minus certain items. Wall Street was looking for 93 cents.

The data center unit, a division that’s larger by itself than all of Nvidia’s nearest rivals combined, had sales of $39.1 billion. That was just shy of the average estimate of $39.2 billion. Gaming-related sales — once Nvidia’s main business — were $3.8 billion. Analysts projected $2.85 billion on average. Automotive was $567 million.

One lingering question is whether U.S. trade restrictions on China will hinder Nvidia’s long-term growth. In April, the Trump administration placed new curbs on exports of data center processors to Chinese customers, effectively shutting Nvidia out of the market. The chipmaker said on Wednesday that it incurred a $4.5 billion writedown because of the issue.

“The broader concern is that trade tensions and potential tariff impacts on data center expansion could create headwinds for AI chip demand in upcoming quarters,” Emarketer analyst Jacob Bourne said in a note.

Nvidia also disclosed that it’s facing scrutiny inside China, where regulators have demanded that it keep supplying local companies in return for regulatory approval of its acquisition of Mellanox. The company warned that it may face penalties in that case. Nvidia completed the purchase of Mellanox, a maker of networking technology, in 2020.

“Regulators in China are investigating whether complying with applicable U.S. export controls discriminates unfairly against customers in the China market,” it said in a filing. “If regulators conclude that we have failed to fulfill such commitments or we have violated any applicable law in China, we could be subject to financial penalties, restrictions on our ability to conduct our business.”

On the call with analysts, Huang was asked whether the company will produce a new chip that will let it resume shipping to China. It had earlier created the less-powerful H20 product for that purpose, tailoring it to meet previous U.S. rules. But stricter curbs now limit its sale in the country.

Huang said that Nvidia couldn’t reduce the capabilities of the H20 further and still field a product that was useful. However, the company is pondering whether it can come up with something “interesting” for the market. He said Nvidia is just discussing the idea and has nothing currently. Nvidia will consult with the U.S. government if it’s able to design something.

The CEO used the call to renew his appeal to the Trump administration to allow it to produce chips for China again. Without getting that clearance, global leadership in AI isn’t guaranteed, he said. Chinese companies will succeed in AI by themselves, Huang said.

“Losing access to the China AI accelerator market, which we believe will grow to nearly $50 billion, would have a material adverse impact on our business going forward and benefit our foreign competitors in China and worldwide,” he said.

Nvidia isn’t the only tech company grappling with the Trump administration’s tougher stance toward China. HP Inc., which also released results on Wednesday, warned of “trade-related” costs in the face of tariffs and a slowing economy. Its shares tumbled about 8% in late trading following the report.

Some providers of chip design software, meanwhile, have been warned by the administration to stop selling their products in China, Bloomberg reported.

Nvidia, which first gained fame selling graphics cards to gamers, has become an AI powerhouse in the past two years. The Santa Clara, California-based company was quick to realize the potential for what it calls accelerated computing — a hardware-and-software arrangement that is setting the stage for machines that can learn and reason like humans.

The chipmaker’s ascent to a market value of more than $3 trillion, about 10% of the total value of the Nasdaq, has investors judging it by extremely high standards. They’ve become accustomed to rapid growth and stratospheric profitability. Even marginal misses relative to those lofty estimates stoke fears about the AI boom slowing down.

Nvidia accounts for about 90% of the market for AI accelerator chips, an area that’s proven extremely lucrative. This fiscal year, the company will near $200 billion in annual sales, up from $27 billion just two years ago.

While Nvidia is being squeezed out of China, other policy changes may help open up additional markets. The U.S. president recently visited Saudi Arabia and other states in the Middle East, where he announced large AI projects. That reversed a push by his predecessor to clamp down on the region’s access to AI technology.

Huang was asked whether he’ll unveil similar plans in other countries. He said he’s traveling to Europe next week.

“I will be in France, UK, Germany, Belgium,” he said in a Bloomberg Television interview. “And I think it is very clear now that every country recognizes that artificial intelligence, like electricity, internet and communications, is part of a national infrastructure.”

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments