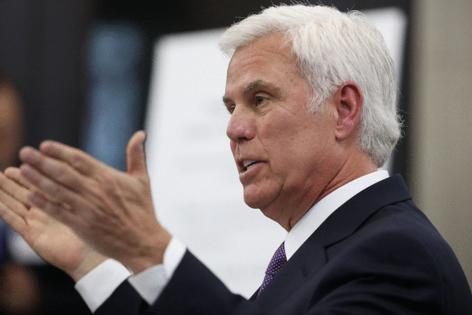

Judge was right to toss racketeering charges against political power broker George Norcross, NJ appeals court says

Published in News & Features

A New Jersey appellate court on Friday declined to reinstate racketeering charges against Democratic power broker George E. Norcross III, dealing a fresh blow to prosecutors who had accused him of running a criminal enterprise.

The three-judge panel affirmed a lower court order dismissing a 13-count indictment against Norcross, 69, and five codefendants, whom a grand jury alleged used threats of economic and reputational harm — as well as their control of Camden government — to obtain property on the city’s waterfront from a developer and a nonprofit.

Acting Attorney General Jennifer Davenport — Democratic Gov. Mikie Sherrill’s nominee for the post — will now have to decide whether to file another appeal in a case that was brought by her predecessor. A spokesperson said the Attorney General’s Office is reviewing the decision.

Mercer County Superior Court Judge Peter Warshaw ruled last February that none of the threats described in the June 2024 indictment were unlawful because, he said, state law permits such statements in the context of economic bargaining. Warshaw also found the charges were time-barred.

The state Attorney General’s Office appealed Warshaw’s decision, arguing that the judge had failed to review thousands of pages of grand jury evidence and that the indictment properly alleged criminal extortion.

On Friday, the appellate court in a 92-page opinion upheld Warshaw’s order but did so on different legal grounds. The panel said several of the indictment’s racketeering conspiracy and extortion charges were time-barred under the statute of limitations. Other counts failed to state a crime, were untimely, or both, the panel said.

In addition to Norcross — founder of insurance brokerage Conner Strong & Buckelew and chair of Cooper University Health Care — the grand jury charged his brother Philip, CEO of the law firm Parker McCay; attorney William Tambussi; former Camden Mayor Dana L. Redd; Sidney R. Brown, CEO of logistics firm NFI; and John J. O’Donnell, an executive at residential developer The Michaels Organization.

Statute of limitations

The case centers on Norcross’ efforts to acquire real estate in Camden following a 2013 New Jersey law he allegedly shaped that turbocharged corporate tax incentives for development in a city that had faced decades of disinvestment.

Prosecutors say that from 2014 through 2016, Norcross and his associates threatened a nonprofit redevelopment group and Philadelphia developer Carl Dranoff, coercing them into selling property for less money than they believed it was worth.

Norcross and his partners then used the properties to obtain millions of dollars in state tax credits for various corporate entities and later sold the credits for cash, the state says.

In contrast to the lower court judge, the appeals panel did not weigh whether the threats allegedly made in 2014 and 2016 were unlawful. Instead, the panel said the charges associated with those threats — racketeering and extortion conspiracies — were filed by prosecutors beyond the five-year statute of limitations.

To comply with that statute, prosecutors needed to show that the conspiracies outlined in the June 2024 indictment continued past 2019. The state contended that it met this burden because corporate entities controlled by Norcross continued to receive tax credits during that period and because the indictment says the power broker took steps to conceal his conduct in the years since.

But the appellate panel agreed with Warshaw that “the objects of the conspiracies were concluded” with the completion of the redevelopment deals years earlier.

The court also rejected the concealment argument, saying the indictment does not meet a legal requirement alleging an “agreement among the conspirators to continue to act in concert in order to cover up, for their own self-protection, traces of the crime.”

Dealings with Carl Dranoff

The appeals court did find that another charge related to waterfront real estate dealings was timely, but failed to satisfy other legal requirements.

When Dranoff in 2018 tried to sell the 349-apartment Victor Lofts to a real estate investment firm for $71 million, the indictment says he faced resistance from Camden officials. They agreed to “slow down” a government approval at the direction of Philip Norcross — an attorney who, like his brother, had no official role in city government, the indictment says.

The sale ultimately fell through, and the city moved to terminate Dranoff’s option to develop another property known as Radio Lofts. The dispute led to years of litigation, and Dranoff ultimately settled with the city in 2023, agreeing to forfeit his rights to Radio Lofts and pay Camden $3.3 million despite believing “he was in the right,” according to the indictment.

Prosecutors allege this was another conspiracy to extort Dranoff. But while the alleged conduct occurred within the limitations period, the appeals panel said, the indictment failed to meet the legal requirements for alleging conspiracy to commit extortion. For example, neither George Norcross nor his codefendants were accused of threatening or planning to threaten Dranoff to settle, the panel said.

Serving on the panel were Appellate Judges Greta Gooden Brown, Lisa Rose and Ellen Torregrossa-O’Connor.

©2026 The Philadelphia Inquirer, LLC. Visit at inquirer.com. Distributed by Tribune Content Agency, LLC.

Comments