For Amazon, Microsoft and other Seattle tech firms, it's AI and anxiety

Published in Science & Technology News

In little more than five months, Amazon and Microsoft have announced they're collectively cutting more than 29,000 roles.

Microsoft has let go more than 15,000 workers since May, and Amazon announced last week it was cutting 14,000 roles. Artificial intelligence has taken some of the blame for the layoffs, but not in an obvious way.

The companies aren't in financial distress — far from it. Rather, there's a desire now among the tech giants to trim their operations, to be lean and flexible enough to keep up with AI development. For the first time in tech's recent history, allocating capital toward employees isn't the top priority.

Since Nov. 30, 2022, when AI giant OpenAI launched ChatGPT, tech companies have poured hundreds of billions of dollars into computer chips, data centers and new talent. And that spending isn't slowing down, even after record investments in 2025.

While some startups are eschewing junior coders in favor of AI models their leaders can control, AI cannot yet replace most employees. Rather, companies like Microsoft and Amazon say they want flatter leadership structures and less bureaucracy.

As Amazon CEO Andy Jassy said last week, the layoffs aren't financially driven nor are they caused by artificial intelligence, at least not directly. Instead, tech companies are radically rethinking how they're structured, and which jobs they need to fill.

The opportunity to bring AI into both work and home is the promised land that almost every tech company hopes to reach. The promise of AI is simple: It will streamline tedious tasks that eat up hours, leaving more time to stretch creative muscles and enjoy life.

At work that might mean a team developing a new product. At home, it's re-creating a pirate ship from a jumble of Legos.

AI usage

When Maggie Stringfellow uses artificial intelligence at work, she’s usually analyzing reams of data that would have been almost impossible to sort without the technology.

When Stringfellow, a vice president of product management at Seattle cybersecurity giant F5, uses AI at home, she’s playing with Legos.

It’d be more fair to say her children are playing with the toy bricks, as Stringfellow says she’s able to take a photo of the mess of Legos her kids have and an AI model will spit out a design for something new.

Stringfellow never had much anxiety around AI.

“I might be a bit on the nerdier side, so I always thought this was going to be a really exciting tool,” she said. “I would say it took awhile for the business tools to evolve and really become useful, but they certainly have.”

Stringfellow is perhaps more optimistic than some tech workers, but her use of AI isn’t uncommon among those at startups, midsize firms like F5 or tech giants. There’s uncertainty about the future — will AI eventually replace jobs en masse? But for the time being, having AI handle some of your work is handy.

In her personal life, Stringfellow can use any AI product she wants. After finishing a young adult novel, she'll go back and forth with a few different chatbots to gather new recommendations. She's also using generative AI, which can produce sentences and images from a user's prompt, to design marble runs and Lego sets with her kids.

Microsoft, which sells AI services called Copilots attached to its existing offerings, said the technology is saving some of their teams days of work. Marketing teams use Copilot to cut down the time to create a campaign from 12 weeks to three weeks, according to Microsoft. Another highly technical team had to migrate apps from one platform to another; with Copilot it took them about half a day compared with four days.

But there’s some skepticism. One Microsoft software engineer said he uses Copilot more than he thought he would. On a given day, he’ll use it for an hour by assigning it relatively easy tasks. He ends up having to polish the results.

“Sometimes it goes well, sometimes not,” he said, speaking on condition of anonymity to protect his job.

A data scientist at Microsoft, also speaking anonymously to protect her job, said she’ll use Copilot from time to time, but the tools available right now aren’t much help to her job. Even if there’s pressure to use it.

A fever pitch

In Washington state, diffusion of AI is at a trickle in some counties while others embrace the technology. More than 30% of the working-age population uses AI in King County, according to data collected by Microsoft. Snohomish County leads the state with more than 35% using the technology.

That number plummets in rural areas like Ferry County, where less than 3% of the population uses AI. Seven counties in Eastern Washington have usage rates below 10%.

Still, AI may become unavoidable as companies increasingly include it in widely used products, like Google's search function.

In the future we're going to be using AI and not even know it," Stringfellow said. "It's going to be embedded into all of our tools and all of the ways we work."

The hype of the technology is feverish.

Amazon, the longtime market leader in cloud computing, was on its heels this summer during an earnings cycle in which Microsoft's cloud division results thrilled Wall Street and Amazon's underwhelmed.

Amazon's share of the cloud market is starting from a larger position so it's difficult to show quick growth, as CEO Andy Jassy pointed out during an earnings call. But there was a perception this summer that Microsoft was making gains in AI while Amazon fell behind.

Wall Street's sentiments almost flipped last week during the most recent earnings cycle. Microsoft's announcement Wednesday that it was spending more than expected on AI infrastructure worried investors.

Microsoft had been expected to slow on spending but ended up reporting a record $34.9 billion in capital expenditures for the quarter, building infrastructure to support a technology that has yet to show significant return on investment.

A day later, Amazon's cloud division sales outperformed expectations and the company's share price surged.

Microsoft's close relationship with OpenAI, which set off the AI race in 2022 when it launched ChatGPT, has given the tech giant a head start in introducing AI-powered tools to its customers.

"It seems to reflect more on where the companies themselves are in this race," said Jean Atelsek, a senior research analyst for S&P Global Market Intelligence. "Amazon Web Services is at the beginning while Microsoft is mature."

Bureaucracy

ChatGPT’s launch date, Nov. 30, 2022, now serves as a dividing line. Is your startup a pre-GPT or post-GPT company? Are you selling standard software or developing AI tools?

Kirby Winfield, founder of AI-focused and Seattle-based venture capital firm Ascend, said startups founded after ChatGPT launched follow a different hiring pattern than tech companies had before.

Startups founded after ChatGPT hire less than those founded before, Winfield said. But he's also seeing revenue for those startups increase faster than before.

Winfield said his firm funded a company that started with six engineers before paring down three. It was faster to have senior people use AI products to code than hire junior employees.

“They just don’t need as many people to write the code,” he said.

He said the startups founded before ChatGPT have what he calls outdated technical and hiring models.

On the technical side, these startups are bolting AI onto their products and rushing to get customer-facing AI tools out. On the people side, they’ve filled roles that may fall out of favor in an AI age.

“It’s very hard to unpack and turn around,” Winfield said.

Big Tech is a collection of companies structured like those pre-GPT startups, but on a much grander scale. Most of the giants spent the 2010s hiring as many people as they could. They have established product lines with years of research and development poured into each. AI is disrupting much of that.

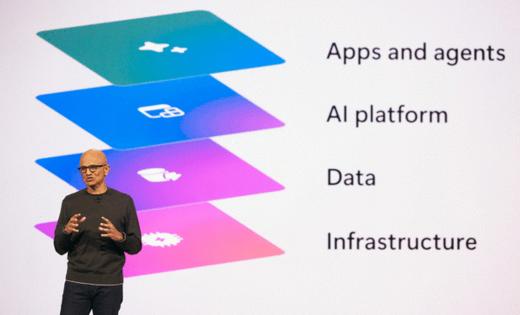

For Microsoft, one of the biggest shake-ups outside of layoffs was the company's decision in October to promote sales chief Judson Althoff to CEO of commercial business. The new role would put him in charge of a segment of Microsoft that represents 75% of the company's revenue.

The move isn't a succession plan for Microsoft CEO Satya Nadella, but rather a way to move Nadella back into "founder mode," according to Althoff. With the move, Nadella is spending more of his time with technical leadership during what Nadella terms a "generational platform shift."

Amazon's leadership ranks aren't shuffling as dramatically. The company is more focused on alleviating what it calls bloat.

Last year, Amazon created an email address where employees could flag bureaucracy, CEO Jassy told a Seattle crowd in September during a company conference.

“You can't wake up one day and decide you’re going to move fast and have the organization move fast,” Jassy said. “But if it's a priority to you and your leadership team to move quickly, you can make that happen.”

Employees are encouraged to alert leadership of areas where things can move more quickly. Jassy said it’s brought in about 1,500 emails, about 500 of which have been addressed.

Two days after Amazon's sweeping layoffs last week, Jassy again made his pitch for a more nimble company — or what he calls the world's largest startup.

When asked by an analyst about the layoffs, he said it wasn't a financial decision or even one driven by AI. Instead it's about removing layers and putting everyone in the company into the hybrid player-coach role.

"I don't know if there's ever been a time in the history of Amazon, or maybe business in general, with the technology transformation happening right now, where it's important to be lean," Jassy said. "It's important to be flat, and it's important to move fast. And that's what we're going to do.

©2025 The Seattle Times. Visit seattletimes.com. Distributed by Tribune Content Agency, LLC.

Comments