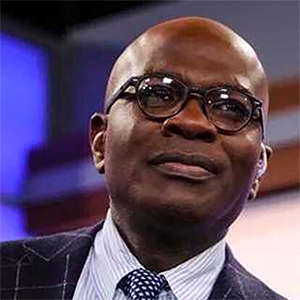

Editorial: Brandon Johnson turns to taxing groceries

Published in Op Eds

Mayor Brandon Johnson has positioned himself as a champion of working families and the poor. But his messaging is getting complicated as it collides with the city’s difficult fiscal reality.

“You all know my position. The ultra-rich continue to get away with not having to put more skin in the game,” he said at a Tuesday news conference.

But at the same time, Johnson is pushing for a grocery tax that will disproportionately hurt families at the checkout line as they try to put food on the table.

His administration is taking an obfuscational messaging approach to explain its position. Johnson insists this isn’t a new tax — it’s merely a local continuation of a state tax being phased out. But for struggling families, the semantics won’t matter.

Higher grocery prices are higher grocery prices.

“(The grocery tax) was a function that the state of Illinois decided to relinquish, and leave it to the cities to collect the tax,” Johnson said earlier this week. “So we’re not creating a grocery tax, we’re just creating a process by which we can collect it.”

That’s some twisty logic, to say the least. A tax is a tax even when a mayor calls it a “function.”

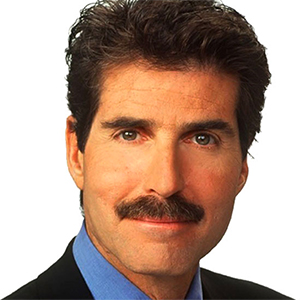

It’s true that when Gov. JB Pritzker ended the state’s 1% grocery tax, he left the door open for cities to collect their own — being as state grocery tax revenues flow to municipalities, not state coffers. Chicago stands to lose $80 million in revenue from the change — at a time when it’s already facing a $1 billion budget shortfall. But the budget problem is not just Springfield’s doing. It’s a reflection of City Hall’s unwillingness to rein in spending and make hard choices. And now, instead of leading with reforms, the mayor is reaching for the easiest — and most regressive — option on the shelf.

The mayor has put himself in a corner on this one.

If his goal is tax fairness, it’s hard to see how making food more expensive for struggling Chicagoans fits the bill.

In a better world, Chicagoans would be getting a small break at the grocery store. Pritzker has acknowledged the regressive nature of the grocery tax and its impact on families. “Even with inflation cooling off every dollar counts, so I’m proud we’re doing what we can to make trips to the grocery store a little easier,” he said in 2024 after eliminating the statewide grocery tax.

We have said much the same, noting that the grocery tax does not need to be there, especially since its absence might contribute in some small way to motivating people to cook healthy meals at home rather than stopping at the local fast-food outlet.

In a few months, the working group Johnson convened to explore budget cuts and revenue options for addressing the city’s structural budget challenges is expected to share its preliminary recommendations, ahead of the mayor’s budget proposal later this year.

We’re interested to see what the group comes back with — hopefully sooner rather than later. We’re aware that the city’s finances are so grim there may be no choice but to add back the grocery “function,” or tax. We’ll leave our final view on that until we see a fuller picture of ideas.

Until now, the mayor’s efforts to introduce widespread new revenue sources have been met with stiff opposition and a lack of public support.

First, his flagship fiscal proposal, a real estate transfer tax hike dubbed “Bring Chicago Home,” failed, a rude awakening that Johnson’s election was not a mandate for sweeping new tax hikes. Next, an attempt to build support for a $300 million property tax hike fizzled out amid understandable public resistance and pushback from aldermen.

We opposed both ideas.

We say these outcomes are a reflection of the general sentiment among Chicagoans, most of whom are sick to death of being asked for more as the city gives them more of the same, often worse, public services. The mayor’s grocery tax push will certainly be met with resentment.

If he wants to make it happen, the grocery tax will need to be adopted as an ordinance by the City Council and submitted to the state by Oct. 1 in order for the tax to be imposed beginning Jan. 1, according to the Illinois Municipal League.

Even Johnson’s supporters may struggle to square this proposal with his progressive ideals. It’s hard to claim you’re standing with working families while taxing their daily bread.

_____

©2025 Chicago Tribune. Visit chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments