Allison Schrager: Megabills didn't break the economy before and won't now

Published in Op Eds

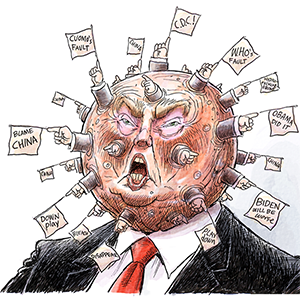

Opinions of the One Big Beautiful Bill tend toward the extreme. One of its main authors calls it “the greatest piece of Republican legislation in a generation,” while one of its most authoritative critics says it makes him ashamed to be an American. So allow me to offer what counts as a radical view: The bill is neither as terrible as its opponents say nor as impressive as its supporters claim.

The reason markets are not responding more to the 870-page bill is that they see it for what it is — just another in a very long line of very big bills that add to the debt but won’t break the economy, at least not soon.

Such bills always contain some good stuff and some bad stuff. Some of the better provisions of this bill make permanent the beneficial aspects of Tax Cut and Jobs Act of 2017. The increased standard deduction, for example, makes the tax code less distortionary. Allowing full expensing for corporate research and investment will increase growth.

The bill also keeps the lower rates from the 2017 law, which accounts for a lot of its multitrillion-dollar cost. That’s something America can’t really afford — but it doesn’t need a sudden $4.5 trillion tax increase that hits the middle class, either. When the US increases taxes, there are better ways to do it.

One of the more controversial aspects of the bill is its cuts to Medicaid in the form of work requirements for able-bodied, working-age adults who aren’t caregivers. The Congressional Budget Office estimates that this will kick 11.8 million people off health insurance. But the CBO’s record in predicting the effects of health-care legislation is not great, and there are reasons to think this could be an overestimate. If that’s true — see what I mean about these big bills being a mixed bag? — that means more debt.

At any rate, it’s clear that Medicaid needs reform. Its costs have been growing over the decades, even compared to other entitlements, as states enroll more people and pay more for services. The design of the program, in which the federal government pays most of the costs and the states provide the care, invites waste and inefficiency: States tax hospitals and nursing homes, and then claim more federal funding to finance the higher cost of care the tax imposes. This bill takes a step in the direction of reform and prevents states from charging higher hospital taxes.

Of course, there’s bad stuff in the bill, too. Eliminating taxes on interest payments for car loans, increasing the SALT cap, and raising the exemption for estate taxes is regressive and expensive. It’s also hard to justify not taxing tips or overtime pay.

Still, for most Americans, their taxes and health insurance will remain unchanged. If Americans bear any cost in the near term, it will be in the form of higher interest rates from increased debt levels. And it is hard to pin that on this bill alone, given the nonstop spending bonanza the government has been on since the pandemic.

The main problem with this bill is it was a missed opportunity to take on the government’s growing debt crisis. America needs major reform to both broaden the tax base and simplify the tax code. It also needs more entitlement reform — not just Medicaid, but Social Security and Medicare, too. The bill addresses none of this.

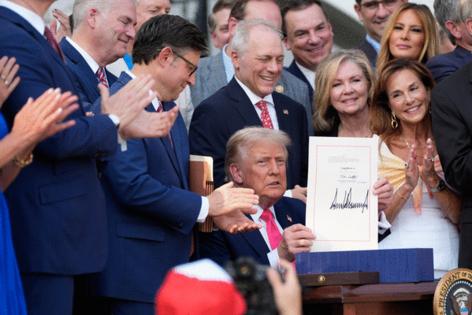

To be fair, President Donald Trump did not run on that platform. Promising to increase taxes and cut benefits may not be a winning strategy politically, but that doesn’t mean it’s not necessary. Hyping this bill as either an economic disaster or triumph is missing the point. It’s just another piece of legislation that is adding to a slow-moving disaster.

____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of “An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.”

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments