Commentary: Taxpayers shouldn't foot the bill for student loan 'forgiveness'

Published in Op Eds

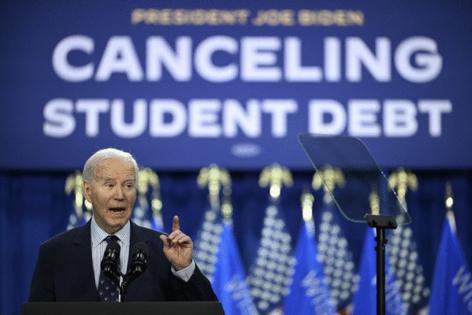

Some college students have learned they won’t have to repay their student loans. Is President Donald Trump’s administration trying to woo young voters with loan “forgiveness” like the last White House?

No. In fact, the Trump administration tried to prevent any student loans from being forced on taxpayers to repay instead of borrowers. The administration is now simply following the law while simultaneously trying to wind down federal overreach in education.

A bit of history: Since the COVID years, students had paid zero — nothing — on their student loans, but such debts did not disappear. Students were still enrolled in college and taking classes, but interest on student loans and the outstanding debts on hundreds of thousands of loans had shifted to taxpayers.

Former President Joe Biden approved executive orders that would have required taxpayers, not student loan borrowers, to pay hundreds of billions in student loan debt. By February 2024, taxpayers were on the hook for $138 billion they did not borrow under what is known as the SAVE plan.

A U.S. Supreme Court order in August of last year protected taxpayers and stopped SAVE, and another federal court ruled Biden’s transfer of payments to taxpayers unlawful in February 2025.

Biden’s SAVE plan created chaos for taxpayers by moving billions in student loan repayments to you and me. But it also caused problems for borrowers because students moved their loans from various repayment plans to the SAVE plan — which would later be ruled illegal. Students now have to navigate switching out of the SAVE plan to other lending options such as Income-Based Repayment and Income-Driven Repayment plans.

In March, a K-12 teacher union filed a lawsuit to restart “forgiveness” — the shifting of debts to working Americans.

Federal officials in the Trump administration are now trying to simplify student loans and create space in the loan market for private lenders to give students more options. Earlier this year, federal lawmakers began phasing out two other loan programs (the Income-Contingent Repayment and the Pay as You Earn plans), which will help to reduce Washington’s oversized role in student lending.

Washington was not always the lender of choice for students. Over the years, poor administration and COVID-era delays have resulted in $1.7 trillion in outstanding student loan debt—debt that will inevitably be shouldered by taxpayers if students default.

Which brings us to the present. Some students are still using the Contingent and Pay as You Earn plans. By law, students who borrow under these plans can have debts paid by taxpayers after a certain period (20 years for Pay as You Earn and 25 years for Contingent loans).

And this is what headlines are referring to when media report that the Trump administration is “forgiving” student loans. In truth, the administration is complying with federal law and court decisions concerning legacy student loan programs. Until the old plans are phased out, some borrowers can continue to force taxpayers to finish out any unpaid debts—hardly a fair deal for working-class Americans.

The administration and Congress should be applauded for reducing federal involvement in education and trying to streamline student lending.

Taxpayers should not be on the hook for unpaid student loan debts.

Instead, if businesses need skilled employees, they should offer scholarships to students and consider the tuition payments to be an investment. State lawmakers should scrutinize higher education spending to determine whether colleges and universities are affordable for eligible students and ask whether colleges need another climbing wall or lazy river.

And taxpayers should remember that once money is borrowed to pay for college, those payments do not disappear into “forgiveness.” Teacher unions and other special interest groups on the left want you and your co-workers, friends and family to pay for someone else’s college debts.

______

Jonathan Butcher is Acting Director for the Center for Education Policy and the Will Skillman Senior Research Fellow in Education Policy at The Heritage Foundation.

_____

©2025 Tribune Content Agency, LLC.

Comments