Powell says tariff impact on US prices seen coming this summer

Published in Business News

Federal Reserve Chair Jerome Powell repeated that the U.S. central bank probably would have cut rates further this year absent President Donald Trump’s expanded use of tariffs.

“In effect, we went on hold when we saw the size of the tariffs and essentially all inflation forecasts for the United States went up materially as a consequence of the tariffs,” Powell said Tuesday on a panel alongside other prominent central bank leaders moderated by Bloomberg’s Francine Lacqua.

“We think that the prudent thing to do is to wait and learn more and see what those effects might be,” he added.

Still, when asked if July were too soon for a rate cut, Powell didn’t rule out the possibility.

“We are going meeting by meeting,” he said at the European Central Bank’s annual Forum on Central Banking in Sintra, Portugal. “I wouldn’t take any meeting off the table or put it directly on the table. It’s going to depend on how the data evolve.”

The Federal Open Market Committee next meets July 29-30 in Washington.

The Fed chief said he expects the impact of tariffs to show up in inflation data in coming months, while acknowledging that uncertainties remain.

“We’re watching. We expect to see over the summer some higher readings,” he said.

He added that policymakers are prepared to learn the impact could be “higher or lower, or later or sooner than we expected.”

The U.S. central bank is wrestling with an awkward tension between its forecasts and recent data.

The Fed has held off on lowering interest rates this year — despite intense pressure from Trump — in part to determine whether tariff-driven price hikes might evolve into more persistent inflation. But so far, broad price hikes aren’t showing up.

Policymakers voted unanimously in June to once again hold rates steady. However, updated quarterly projections showed a divide among officials over the likely forward path of rates.

While 10 policymakers foresee at least two cuts this year, seven projected no cuts in 2025. Another two penciled in just one reduction before year’s end.

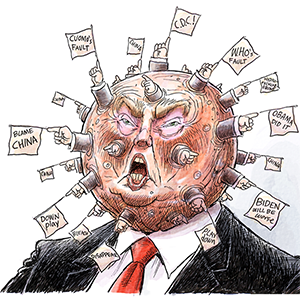

Trump’s imposition of new levies on dozens of U.S. trading partners, along with his frequent variations on the specifics of the duties and halting progress on striking trade deals, has injected uncertainty into the economic outlook. Forecasters widely expect the tariffs to put upward pressure on inflation and dent economic growth.

Still, economic data have shown little impact from the tariffs, either in prices or the labor market. Data released Tuesday showed U.S. job openings unexpectedly rose in May to the highest level since November.

Trump and several top administration officials have seized on the positive data as they demand lower rates.

Round of applause

“We’ve always said that the timing, amount and persistence of the inflation would be highly uncertain,” Powell said Tuesday.

Two Trump-appointed Fed governors, Christopher Waller and Michelle Bowman, have argued a rate cut could be appropriate as soon as the Fed’s meeting later this month. Both have cited benign economic data as among the factors influencing their view.

When asked whether attacks from Trump were making it more difficult for him to do his job, Powell drew a sustained round of applause with his response.

“I’m very focused on just doing my job. The things that matter are using our tools to achieve the goals that Congress has given us,” he said. “That’s what we focus on 100%.”

It wasn’t the only show of support Powell received from his counterparts.

“I think I speak for myself, but I speak for all colleagues on the panel,” said ECB President Christine Lagarde. “I think we would do exactly the same thing as our colleague, Jay Powell.”

Powell once again declined to say whether he would leave the Fed when his term as chair expires next May. His term as a governor continues until 2028, but Fed chairs traditionally exit the central bank when their leadership role ends.

(With assistance from Bastian Benrath-Wright, Georgina Boos, Jonnelle Marte and Mark Schroers.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments