Fed holds rates steady, nods to stabilization in jobless rate

Published in Business News

Federal Reserve officials left interest rates unchanged and pointed to improvements in the U.S. economy as they signaled a more cautious approach to potential future adjustments.

The Federal Open Market Committee voted 10-2 Wednesday to hold the benchmark federal funds rate in a range of 3.5%-3.75%. Governors Christopher Waller and Stephen Miran dissented in favor of a quarter-point reduction.

In a post-meeting statement, policymakers said “job gains have remained low, and the unemployment rate has shown some signs of stabilization.” Officials also dropped language pointing to increased downside risks to employment that had appeared in the three previous statements.

The upgraded assessment of the labor market is likely to hold expectations for a near-term rate cut at bay, despite escalating pressure from the Trump administration. Heading into the meeting, investors saw another cut as unlikely until at least June.

The S&P 500 and Treasuries remained lower while the dollar strengthened.

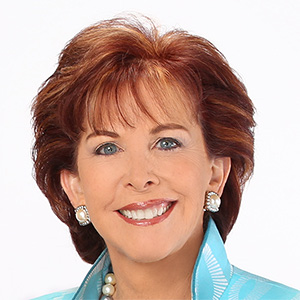

In remarks to reporters after the meeting, Fed Chair Jerome Powell further talked up a “clear improvement” in what’s expected for the U.S. economy in the year ahead.

“The outlook for economic activity has improved, clearly improved since the last meeting, and that should matter for labor demand and for employment over time,” he said.

Wednesday’s decision was widely expected after policymakers lowered interest rates at three consecutive meetings in the closing months of 2025. Based on rate projections issued in December, most officials see the Fed cutting again later this year. But given concerns over still-elevated inflation and signs of stability in the labor market, several policymakers recently indicated they saw no immediate need for an additional reduction.

Policymakers, in their statement, marked up their view of the economy, describing the pace of growth as “solid.” Since October they had said the economy was expanding at a “moderate pace.” They also dropped a reference to inflation having moved up.

In the opening portion of his press conference, Powell avoided answering most questions about the extraordinary political backdrop overshadowing the meeting, including questions about the Department of Justice’s criminal investigation into the Fed chief.

The DOJ earlier this month issued subpoenas to the Fed, prompting Powell to issue an unusually forceful response, accusing the administration of using the investigation as a form of intimidation.

Asked whether he’d made a decision on whether to remain on the Fed’s Board of Governor’s after his term as chair expires in May, Powell said no, and declined to say when he may decide.

Powell did comment on his decision to attend a Supreme Court hearing last week over President Donald Trump’s attempt to fire Fed Governor Lisa Cook.

“That case is perhaps the most important legal case in the Fed’s 113 year history,” Powell said. “I thought it might be hard to explain why I didn’t attend.”

Comforting data

Officials have broadly coalesced around the view that Fed policy is well-positioned for now, offering them time to assess incoming information on inflation and the labor market.

That represents a shift from recent months in which disagreements over the economic outlook led to a spirited debate about the appropriate path for rates. Some called firmly for cuts to support a labor market they viewed as fragile. Others urged caution, citing inflation as the more pressing concern.

Fresh economic data have offered some comfort for both camps. While hiring remains anemic, layoffs have also stayed low and, in December, the unemployment rate ticked lower, suggesting the labor market might be stabilizing.

Figures on consumer prices for December, meanwhile, showed underlying inflation was softer than anticipated. Still, distortions to price measurements from last year’s government shutdown won’t fully unwind until this spring, meaning Fed officials may view the data with limited confidence.

Several policymakers have argued that 175 basis points of Fed rate cuts in the last 16 months have brought policy much closer to the so-called neutral level that neither stimulates nor restrains the economy, further reducing the urgency for more cuts.

An exception is Miran, who’s on unpaid leave as a top White House economic adviser. He estimates the central bank’s benchmark rate remains well above a neutral setting and says the Fed should slash it by 150 basis points this year.

Waller, who is among Trump’s top candidates to replace Powell when his term as chair expires in May, has repeatedly raised concerns about labor market fragility, but more recently signaled the Fed need not rush to lower rates again.

©2026 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments