US seizure of Venezuela oil tanker risks amping up economic pain

Published in News & Features

Venezuela faces a fresh financial shock after the U.S. seized a sanctioned oil tanker off its coast, a move that could choke off one of the few remaining revenue streams for a nation again on the brink of hyperinflation.

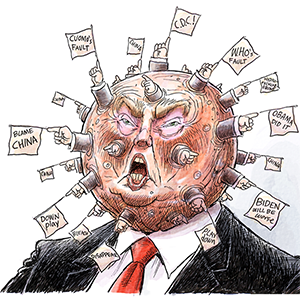

The socialist-run country’s economy has been strained since Donald Trump tightened oil-trading restrictions earlier this year. The government’s supply of dollars, almost all tied to crude sales, had already fallen 30% in the first ten months of 2025. The squeeze has pressured the exchange rate and driven up prices, with annual inflation expected to top 400% by year’s-end, according to private estimates from local economists who requested anonymity for fear of reprisal.

Once one of the Latin America’s richest countries, Venezuela has suffered a prolonged economic meltdown going back over a decade, with around a quarter of its population fleeing for better prospects abroad. This week’s commandeering of the tanker carrying as much as 2 million barrels of oil now threatens a painful new chapter.

“A continued policy of seizures would cause a steep decline in Venezuela’s import capacity, plunging the country into a new recession,” said Venezuelan economist Francisco Rodríguez, a professor of international affairs at the University of Denver.

The renewed deterioration also comes amid a lack of economic data, with the government intensifying its crackdown on independent statistics. Officials have jailed at least eight economists and consultants this year for publishing estimates on inflation, economic activity and the parallel exchange rate.

Economists were already expecting a downturn in 2026 before the aggressive U.S. action. While authorities don’t release regular data, the central bank recently claimed third-quarter growth of 8.7%. That compares to local estimates of about 5% growth for 2025 and a 1% contraction next year, even before the tanker was seized.

The local bolivar currency has lost more than 80% of its value since January, despite government efforts to curb depreciation in the official market. The economy is widely dollarized, yet Venezuelans still rely on bolivars for daily purchases to exploit the exchange-rate differential, swapping dollars at a higher parallel rate and spending the local currency at shops forced to use the official one. To shield themselves from losses, some retailers have begun pricing goods off the euro rate, which is slightly higher.

OPEC-member Venezuela currently exports about 900,000 barrels of oil a day. Roughly 750,000 barrels, or 80%, go to Chinese buyers, according to data compiled by Bloomberg. About 30% of shipments move through a shadow fleet of sanctioned vessels similar to the tanker seized on Wednesday. And now the U.S. is preparing to intercept more ships transporting Venezuelan oil, according to people familiar with the operation.

Washington imposed sweeping economic sanctions on Venezuela in 2019, cutting off access to foreign currency. It took President Nicolás Maduro four years to restore a measure of stability, end hyperinflation, reverse one of the deepest recessions in modern history and cool the currency’s wild swings — largely by allowing broad use of the U.S. dollar.

The recovery proved fragile. Traders now say sales to Asia could become more complicated as buyers demand deeper discounts that would also hit government coffers. Some estimate markdowns could double, reaching as much as $30 a barrel below Brent, according to people familiar with the matter. State-owned driller Petroleos de Venezuela has already been facing pressure in recent months, with vessel delays mounting as price talks drag on.

The Trump administration’s seizure is a “milestone” that marks “a significant shift in Venezuela’s oil revenue projections for 2026, because it should significantly increase the discount, and not only increase it, it could paralyze exports,” said Alejandro Grisanti, a Venezuelan economist and financial consultant. The U.S. move “was a very strong deterrent that should significantly reduce the Venezuelan black market for oil.”

If seizures continue and discounts deepen, the economy will likely feel the impact quickly. Dollar supply is already constrained, and the gap between the official and parallel exchange rates has widened to almost 70%. That’s set to push prices higher in the near term.

The country “is on its way to hyperinflation,” said Alejandro Arreaza, an economist at Barclays. “The impact of a larger oil discount only accelerates the process.”

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments