Consumer

/Home & Leisure

/ArcaMax

These are the Seattle area's Gen Z homeowners. How did they do it?

If you picture a first-time homebuyer in the Seattle area, you probably wouldn’t think of 24-year-old Edwin Nino Delgado with his hip-hop posters taped to the wall of his $770,000 Lake City triplex.

He’s nowhere near the age of the typical first-time homebuyer, which is now a record high of 40 nationwide, according to the National Realtors ...Read more

Gen Zers, just because you can buy a home, should you?

Just because you can buy a home, should you?

It seems like a no-brainer when home prices soar year after year. But experts say first-time homebuyers need to consider factors beyond pure capital before jumping into the market.

The median age of a first-time homebuyer has reached a record high of 40 — a time when most people are settled. But ...Read more

Let's talk about heat pumps: This Pittsburgh utility is helping to train contractors on the science and art of HVAC

PITTSBURGH — Frank Gillis laid out four sheets of fiberglass inside the Penn College Building Performance Lab in Pittsburgh's Homewood neighborhood.

With a knife, he demonstrated how to cut through the insulation layer, stopping short of the aluminum cover — "like filleting a fish" — and how to fold the sheet into a rectangular duct, ...Read more

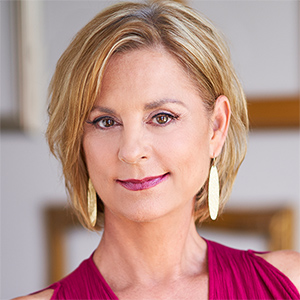

Everyday Cheapskate: A Letter From 13-Year-Old Abby

Dear Mrs. Mary Hunt: My name is Abby. I am 13 years old. So, my mom got your book, "Raising Financially Confident Kids." She is on Chapter 9, and she wants to do that -- give your kids money and make them buy their clothes, shoes, etc., each month.

Well, I didn't really like the idea. I actually thought it was stupid. But I didn't say anything....Read more

Conor Sen: The housing market is moving in favor of Gen Z

The American dream of owning a home has never seemed further out of reach for young people. You can hardly blame Gen Z and younger millennials for adopting an economic nihilism that prioritizes the here and now — whether that’s $400 Lola blankets or risky crypto trading — over stashing money away for a down payment.

But there’s an ...Read more

Neiman Marcus parent sells its Beverly Hills site

LOS ANGELES — The land below the Beverly Hills flagship store of luxury retailer Neiman Marcus has been sold to a New York investor as the owners of the department store chain sell property to pay debts.

Neiman Marcus, which has occupied the 9700 Wilshire Boulevard store since it opened in 1979, will continue to serve customers there as a ...Read more

Everyday Cheapskate: Help! I Have Issues With Your Tub and Shower Soap Scum Cleaner

If I were keeping track of the number of responses from my readers that are filled with praise and gratitude, there would be thousands of hash marks next to Tub and Shower Soap Scum Cleaner. And the word used most often to describe it? "Magical"!

But now and then, a response will report problems having to do with allergies and, well, that smell...Read more

Mortgage rates could drop below 6% in 2026, report says

Mortgage rates could briefly drop below 6 percent in 2026 which could unlock parts of the Las Vegas Valley housing market, according to a new forecast.

Lending Tree’s 2026 Housing and Economic Predictions report expects mortgage rates to drop into the 5 percent range sometime next year, something that has not happened since 2022. Freddie Mac ...Read more

Every Wall Street analyst now predicts a stock rally in 2026

At the big banks and the boutique investment shops, an optimistic consensus has taken hold: the U.S. stock market will rally in 2026 for a fourth straight year, marking the longest winning streak in nearly two decades.

There’s plenty of angst about the risks to the bull run that’s pushed the S&P 500 Index up some 90% since its October 2022 ...Read more

What is a robo-advisor? How it works, how much it costs, and pros and cons

Robo-advisors automate the investing process for you, making it simple to invest in a diversified portfolio of assets — and they cost much less than a typical financial advisor. It’s little wonder that many investors have turned to them, and robo-advisors now manage hundreds of billions of dollars.

What a robo-advisor does

A robo-advisor ...Read more

Everyday Cheapskate: Why I Keep Binder Clips in Every Room

There are a few things I like to keep handy at all times -- nail file, a good pair of sunglasses, and binder clips. Yes, binder clips. The small, black ones with shiny silver handles that come in myriad sizes. The kind you can find in bulk at office supply stores for about the price of a fancy coffee.

I keep binder clips in nearly every room of...Read more

Everyday Cheapskate: Drowning in Scraps of Fabric

Longtime readers of this column may remember the reader who wanted to know where she could donate her fabric scraps. I offered details on a small organization in Texas that turns new fabric scraps into quilts for shelters, churches and other charities.

Apparently, reader G.W. was not the only reader with fabric scraps too good to throw away. "...Read more

Everyday Cheapskate: 12 Ways to Simplify Your Life

Would you be willing to accept a reduction in pay if you could work fewer hours to spend more time with your family? It is a lovely thought, but how realistic is it? Working less usually means earning less -- hardly an option for most people.

But that doesn't mean we cannot take small steps to simplify our complicated lives. A little bit here ...Read more

Everyday Cheapskate: What To Do If You Don't Have Enough Money to Pay All of Your Bills

It might be the rising cost of groceries, or perhaps you've lost your job or have already been living paycheck-to-paycheck with no cushy emergency fund to fall back on. For whatever reason, suddenly this month you can't pay all your bills.

You're scared, angry, worried and overwhelmed. What are you supposed to do right now? Which bills should ...Read more

Everyday Cheapskate: 10 Houseplants That Can Improve Your Quality of Life

I used to think houseplants were nothing more than expensive dust collectors. Then I bought a pothos, neglected it shamelessly and watched it grow anyway. That's when it clicked: Maybe these leafy roommates are doing more for me than I realized.

Science agrees. Indoor plants aren't just for looks. They can help you breathe easier, sleep better ...Read more

Everyday Cheapskate: How to Help Someone You Love Build a Good Credit Score

Dear Mary: I've heard that adding someone to your credit card will help that person establish a credit history, even if they do not use the card. Is that true? How would I go about doing it? -- Pat

Dear Pat: It is true. You would add this adult (at least age 18) as an "authorized user" to your account by calling your credit card issuer's ...Read more

Everyday Cheapskate: Surprising Ways to Use Cornstarch to Save Time and Money

Cornstarch is a low-cost, readily available, humble miracle found in the baking aisle of just about every supermarket and grocery store in the country, and online. Extracted from corn and then processed into a very soft, white powder, cornstarch is sold in boxes and canisters.

Usually, we think of cornstarch as a pantry ingredient used to ...Read more

Everyday Cheapskate: Clean Up the Cloudy Headlight Covers

Well, you've done it again! You clever readers have come up with another batch of fabulous ways that you save time and money every day!

AUTO CLEANER

Use plain old baking soda on a damp rag to remove bugs, tar and anything else from your vehicle. Works great, even on the grill and chrome work. Leaves no residue or odor and won't harm the paint....Read more

Everyday Cheapskate: Common Household Sources of Microplastics Plus Easy Swaps

Dust bunnies don't just multiply under your couch -- they're hoarding plastic. Scientists have discovered that everyday items we use, wash, wear and toss can release microscopic plastic fragments. These "microplastics" are everywhere: bottled water, teacups, indoor air -- even inside human arteries.

If you've ever dusted a sunny windowsill and ...Read more

Everyday Cheapskate: Like It or Not, You Need a Good Credit Score

In my perfect world, there would be no credit scores. And while I do not believe that credit is necessarily evil, in that perfect world of mine, there would be no need for any of that because it would be, well ... perfect!

Back to reality. There are myriad reasons we need to have good credit histories and excellent credit scores.

Like it or ...Read more

Inside Consumer

Popular Stories

- Real estate Q&A: What happens to our lease when our landlord sells property?

- California bill would mandate insurance for homeowners who reduce wildfire risks

- World of Warcraft to partner with Zillow to display in-game homes

- Investors snub the software dip, brace for deeper AI disruption

- How Zillow changed every step of homebuying and selling in 20 years