Signed to Sell -- Can You Still Keep Your Home?

Reader Question: Years ago, we sold our house for a job relocation. We had a buyer and a signed contract, but at the last minute, I found a job at home. We wanted to back out of the contract and keep our house, especially since my husband is disabled, and the house was completely handicap accessible. The buyers refused, and the agents, mine and theirs, threatened to take us to court and sue us if we tried to back out of the sale. I've always wondered if we could have somehow gotten out of the contract and kept our house, especially since it was so perfect for my disabled husband.

Monty's Answer: When a buyer and seller sign a purchase agreement, they create a legally binding contract. From that moment forward, backing out is no longer a matter of simply changing one's mind; it becomes a matter of contract law and risk management. In most states, the default remedy for a seller's failure to perform is "specific performance" -- a court order compelling you to deliver the deed -- or, alternatively, monetary damages that make the buyer whole. Your listing agreement with the broker often contains similar teeth: if you refuse to close, you still owe the commission because, from the broker's perspective, their job (procuring a ready, willing, and able buyer) is complete.

Could you have walked away anyway? Possibly, but only under limited circumstances, and usually at a cost. Here are the avenues sellers typically explore:

No. 1: Contingencies Already in the Contract: Sometimes, there is a seller-friendly contingency, such as needing to find replacement housing, but those clauses must be negotiated at the outset, not after your plans change.

No. 2: Mutual Cancellation: Ask for a release. A disappointed buyer may agree if you sweeten the pot: reimburse their costs or pay an additional sum for the inconvenience.

No. 3: Material Breach by the Buyer: If the buyer misses a performance deadline, you can issue a "Notice to Cure." If they still don't comply, you may terminate legitimately. That option vanishes once they perform on time.

No. 4: Legal Defense -- Impossibility or Hardship: Courts rarely excuse a seller's performance simply because circumstances become less convenient. Even a compelling personal hardship, your husband's disability, would be weighed against the buyer's right to the bargain they struck. A judge is more likely to award damages than to let you cancel.

No. 5: Ignore the Contract and See What Happens: Some sellers roll the dice, refusing to close and waiting to be sued. Often, the buyer negotiates a settlement because litigation is slow and costly. But that strategy is gambling with your equity, legal fees, and credit rating -- and your broker's claim for commission still looms.

Because you closed the sale under pressure, you chose the safest course. Had you refused, the buyers' threat to sue was credible, and the brokerage's threat to pursue its fee equally so. You likely avoided an expensive legal battle and preserved your credit.

Lessons for Future Sellers:

-- Consult a real estate attorney whenever life circumstances shift dramatically mid-deal; a quick opinion can clarify your leverage.

-- Remember the "handicap-accessible" value you surrendered. If a home is uniquely tailored to a family member's needs, weigh that intangible carefully before putting it on the market.

Contracts are promises wrapped in legal steel. Once forged, breaking them is possible but rarely painless.

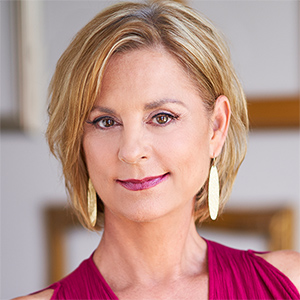

Richard Montgomery is a syndicated columnist, published author, retired real estate executive, serial entrepreneur and the founder of DearMonty.com and PropBox, Inc. He provides consumers with options to real estate issues. Follow him on Twitter (X) @montgomRM or DearMonty.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments