Appraisal Comes in Low: Can We Get Our Earnest Money Back?

Dear Monty: We made a $90,000 offer on a house listed for $97,500. We were pre-qualified for more than our offer. However, when the mortgage company had the house appraised, it came in $14,000 less than our offer. We paid $500 for the appraisal and provided $2000 in earnest money when the offer was made. Are we entitled to the $2,000 earnest funds back based on the lower appraisal? We cannot come up with the additional $14,000, nor do we want to invest that into a house that isn't worth what we offered. Also, is there any recourse to recoup the appraisal cost?

Monty's Answer: You are correct to pause and reassess when the appraised value doesn't support the contract price. Here's how your situation typically plays out in today's market:

No. 1: The Financing Contingency Is Your Safety Net

Assuming your offer was written on a standard residential purchase agreement, there's almost always a financing contingency clause that protects buyers if the home fails to appraise for the agreed price. If your lender will not finance beyond the appraised amount, then the financing condition has not been met. In that situation, your earnest money should be refunded in full. The seller can't compel you to buy a property if the financing fails through no fault of your own. That said, read the financing section of your offer carefully. If you agreed to remove or modify that contingency or failed to provide timely written notice to the seller, that could complicate recovery.

No. 2: The Appraisal Fee Is a Sunk Cost

The $500 appraisal fee is not refundable. This payment is to the lender's chosen appraiser for their work and is not contingent on whether the deal closes. Consider that appraisers are among the few participants in a real estate transaction who get paid regardless of whether a sale occurs. The silver lining? The appraiser may have just saved you from overpaying by $14,000. This is why independent valuation matters.

No. 3: Ask the Seller to Reconsider

Before you walk away completely, it's worth asking your agent to present the appraisal report to the seller. Smart sellers often agree to adjust the price, because if the property doesn't appraise for you, it probably won't appraise for the next buyer either. In today's shifting market, that conversation happens more than many agents admit.

No. 4: If the Agent Resists Returning Your Deposit

If your agent or broker says you cannot recover your earnest money, don't take their word for it. Ask the broker of record, not the agent, to review your signed contract. If the broker agrees with the agent and you still disagree, suggest to the broker that you may get an opinion from the state's real estate commission. Most brokers will take a second look to avoid the time and scrutiny a complaint may bring. Otherwise, ask a real estate attorney to review the contract.

No. 5: Continue Your Home Search With Fresh Eyes

Consider reviewing my article on "How to Determine a Home's True Value." Understanding the variables that drive value when checking comparable sales, condition and location. This review will make you more confident when the next home appears.

You're making wise choices. Each experience makes you a sharper buyer.

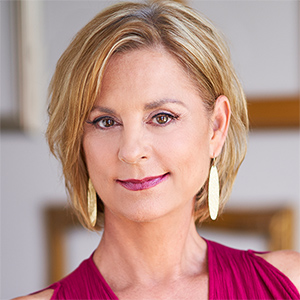

Richard Montgomery is a syndicated columnist, published author, retired real estate executive, serial entrepreneur and the founder of DearMonty.com and PropBox, Inc. He provides consumers with options to real estate issues. Follow him on Twitter (X) @montgomRM or DearMonty.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments