When Your Agent Breaks Promises During a Contingent Offer Sale

Dear Monty: We agreed with the buyers through our agent. They had a contingent offer. Our agent promised us that our house would remain active until the buyer's home was sold. However, she immediately took our house from active to sale pending to appease the buyers. Has she rendered the deal unenforceable? When their house was sold, they failed to make a deposit to escrow within the 2-day requirement. Do we have the right to cancel this agreement?

Monty's Answer: Your agent created unnecessary complications by changing the MLS status contrary to your agreement, but this doesn't automatically void your contract with the buyers. The missed escrow deposit deadline is potentially more significant, depending on the terms of your contract.

Understanding Your Situation

The MLS status change and missed deposit are separate issues. According to the National Association of Realtors' Handbook on Multiple Listing Policy, "pending" typically means the seller has accepted an offer and removed the property from active marketing. Your agent may have violated your instructions, but this does not necessarily invalidate the purchase agreement.

The missed deposit deadline depends on the terms of your contract. Review your contract's contingency removal timeline and default provisions carefully.

Your Options

Option 1: Enforce the deposit deadline. If your contract specifies that earnest money must be deposited within two days and includes "time is of the essence" language, you may have grounds to cancel the contract. Document everything in writing and follow your contract's cancellation procedures precisely. Delays in asserting rights can constitute a waiver of those rights. Pros: Frees you to pursue other buyers. Cons: May face legal challenge if language is ambiguous.

Option 2: Demand immediate deposit with a cure deadline. Please allow buyers 24-48 hours to deposit funds; otherwise, we will cancel the transaction. Pros: Tests buyer commitment; preserves transaction if they comply. Cons: Delays marketing to others; signals tolerance for violations.

Option 3: Address the agent issue. Discuss the unauthorized status change with your agent, and then escalate the issue to your managing broker if you are unsatisfied. You can file a complaint with your state's real estate commission; agents take these seriously as they can affect licensure. Pros: Addresses agency violation. Cons: Does not immediately solve buyer default.

Option 4: Restore active status. Instruct your agent to change the status back to "active" until the contingency is removed, as initially agreed. Continue marketing while this buyer resolves issues. Pros: Attracts backup offers. Cons: May antagonize current buyers.

Critical Next Steps

Review the exact language of your purchase agreement regarding deposit deadlines. Document your agent's promise in writing and email her, confirming, "as we discussed, you agreed to keep the property active until contingency removal." If canceling, follow contract procedures precisely to avoid buyer lawsuits.

Consider mediation if disputes arise; it's faster and less expensive than litigation. Consult an attorney only if the earlier approaches fail. Many attorneys offer a free 30- to 45-minute consultation to help outline the legalities and review documents. If you need more, their fees (typically $200-$400 for an initial consultation) can help prevent expensive mistakes.

The unauthorized status change shows poor judgment, but likely doesn't void the contract. The missed deposit deadline is in your favor, but exercising cancellation rights requires strict adherence to the agreement.

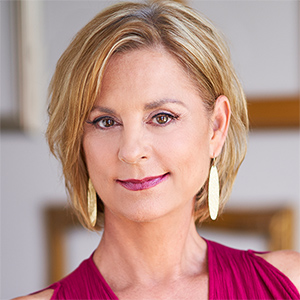

Richard Montgomery is a syndicated columnist, published author, retired real estate executive, serial entrepreneur and the founder of DearMonty.com and PropBox, Inc. He provides consumers with options to real estate issues. Follow him on Twitter (X) @montgomRM or DearMonty.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments