Beneficiaries unsure who should take ownership of deceased man’s home

Q: My father-in-law passed away recently, and his beneficiaries are his second wife and his three daughters from his first marriage. His second wife will receive a fixed amount, with the rest of his assets divided equally among the three daughters. His nice home will also be sold. His second wife wants his daughters to take ownership of the home. Is this best for the daughters, and would it complicate things?

A: We’re sorry for your loss. In answer to your question, it seems your father-in-law wanted to make sure your wife and her sisters got most of what he owned, including his home. His second wife is simply saying that the three daughters should get together and decide when and how to sell the home.

We don’t know how his home was titled. The home might have been in your father-in-law’s name, in the name of a living trust or owned jointly with his second wife. If the home was in his name, you might need to probate his will to sell the home and divide the proceeds from the sale.

On the other hand, if the home was in the name of his trust, you can simply move forward with the sale of the home, and the successor trustee could convey the ownership of the home to a buyer and then split the proceeds from the sale as directed under the trust agreement. We would assume the trust agreement would also state that the proceeds held in the trust go to his three daughters.

One thought we have is that his home may have quite a bit of personal effects, and his second wife might simply want the daughters to decide who gets what and when. She may not want to have to deal with the splitting of assets or the decision-making process in determining which daughter will get what.

So, there are various things going on. On the one hand, it’s the manner in which the home gets sold and legally who would have the right to sell it. On the other hand, you have the mechanics of cleaning out the home, getting the home ready for sale, and then going through the process of selling the home.

We don’t think it will complicate the process. But we do think you need to understand more about the ownership of the home, the estate documents that your father-in-law put in place, and any tax consequences your wife and her sisters may have if they either keep the home or their father had a large estate.

Your wife and her sisters should talk to the attorney that may be handling the affairs for the estate to understand your options or to go through the options you are considering to see if there are any pitfalls.

========

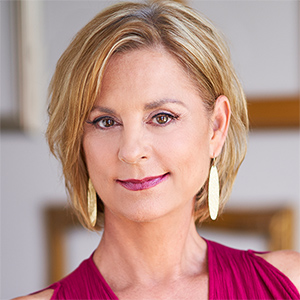

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments