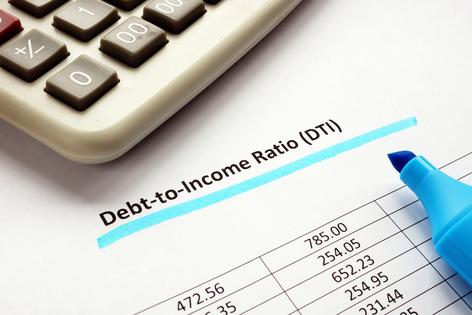

Can you afford the current DTI ratios for a mortgage loan?

Q: I am a mortgage lender and heard you on WGN radio today speaking of mortgages. You were quoting ratios of 28/36% of your gross monthly income. Those were the ratios that you’d hit your head on the ceiling back in the ’80s and early ’90s.

Right now you can easily go to 40/45% of your gross monthly income with a good credit score with 5% down. With 20% down, the bottom ratio could be as high as 50%. And that’s not me making the decision, that’s Fannie Mae’s and Freddie Mac’s automated underwriting system.

I’ve been lending money in Chicago for major banks for the last 40 years and I’m ultra conservative.

A: Thanks so much for your comments. You are correct in your statement about the debt-to-income (DTI) ratios for mortgage loans. Lenders will allow buyers to go up to 45% of gross monthly income on low down payment loans.

But, is that a good idea? What do those ratios mean when translated into take home pay and our readers’ daily lives?

Let’s start with Ilyce’s comments on the radio. The 28/36 refers to 28% and 36% of your gross monthly income. Conventional lenders allow you to spend up to 28% of your gross income on your mortgage payment of principal and interest, insurance premiums, and property taxes, and homeowners assessments, if you buy in a condo building or community with an HOA fee. This is commonly referred to as PITI.

Lenders will allow you to spend up to 36% of your gross monthly income on all of your debt service. That’s PITI plus credit card monthly payments, student loan payments, auto loan payments, personal loan payments or anything else. (Soon, we believe that loans made through By Now Pay Later companies like Affirm will also be included in this ratio, but that’s another story.)

We believe that conventional lending standards keep this general rule in place. Many consumers don’t understand that this DTI standard applies to gross income, not after-tax income. After tax, even the 28/36 DTI standard can make it difficult to get bills paid.

Here’s how it works. Let’s say your gross monthly income is $5,000 per month, or $60,000 per year and your net pay is around $4,000 monthly, or $48,000.

Conventional lenders will allow you to pay no more than $1,400 (28% of $5,000) for your mortgage interest and principal, insurance premiums and property taxes. You’ll be able to spend no more than $1,800 per month on those expenses plus your other debt service payments.

On an after-tax basis, these payments will feel like a bigger chunk of your take-home pay. If your net pay is $4,000, $1,800 is more than 45% of your take-home pay. And that leaves only $2,200 to pay all the rest of your expenses, including health care costs and insurance premiums, 401(k) contribution, emergency savings, child care, food, gas for your car or other transportation costs, utilities, cable and cellphone bills. It’s pretty tight for a budget.

Our correspondent is correct. There are different loan programs that will allow borrowers to stretch these numbers out further. But if you spend 45% of your $5,000 gross monthly income on your principal, interest, taxes, insurance and debt service, that’s $2,250, or over 56% of your take home pay.

We think that kind of borrowing will result in a crushing burden on some homeowners and can result in a lot of additional financial stress over the long run. Why would you want that?

It’s all good, until it isn’t. And if the housing market or the economy turns on a dime, as happens every now and again, people who are living on the edge will be in trouble financially.

Even if we don’t fall into a major recession where millions of people lose their jobs, homeowners often forget that homes have problems and things go wrong in life. You might need a new heating or cooling system, a new roof, or even a new snow plow. You could have unexpected medical expenses, lose your job, get divorced, get sick, or need to replace a dishwasher.

More than half of Americans are living paycheck to paycheck. In good times, that’s OK. You can get by and hope your prospects improve over time.

You just never know what will happen tomorrow. Our best advice? Don’t overpay or take on more debt that you can comfortably afford to pay each month and you’ll avoid the kind of financial stress that can ruin marriages, friendships, and lives.

========

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments