Beneficiary worried siblings will not play fair as executors of mother’s estate

Q: My mom left a will stating all of us are to receive an equal portion of her estate. It names my eldest and younger siblings as executors.

My brother and his wife have been trying to take my parents’ home for years. They have told us they are paying $150,000 for the house due to the work it needs. The home is a two-story, brick home on two acres in Virginia. Homes go for around $700,000 on their street. When I questioned the price, my siblings say that they are the executor and this is what is happening.

Some of my siblings tried to move my parents into assisted living, but my parents resisted. My mother is now terminal. My sibling who wants the home got an appraisal of the home and wants to buy it for an under market price. The house is gorgeous. I am afraid that if I do not have a plan for when my mom dies, I will be ripped off by my siblings. I would think that the home should go on the market and the proceeds of the sale would then be split equally between the four kids. Any advice on how to handle this?

A: There are several issues we want to unpack. The first is that your mom is still alive and your siblings have no right to any of your mom’s assets while she is living. Your mom’s will only takes effect once she has passed. However, if your siblings have power of attorney for your mom’s financial matters, they could sell the home now using that power of attorney.

Whether your siblings have a power of attorney over financial matters while your mom is alive, or they are executors of your mom’s will once she passes, they have a duty of good faith and have a duty to deal fairly with all of the beneficiaries of your mom’s estate. That does not mean they will, but the law likely requires them to deal fairly with you and to account for their actions.

Unfortunately, you might need an attorney to make sure your siblings take seriously their duties under the power of attorney for financial matters or as executors of the will. We aren’t too concerned with the appraisal that was done of the home. You can do your own appraisal, or when the time comes force the estate to obtain an appraisal.

Have your siblings taken financial advantage of your mom? If so, your state likely has laws that could penalize them for that abuse. These “abuse of the elderly” laws are in place to prevent loved ones from losing their assets or to prevent financial abuse by people that claim to be close to them.

Do you have documentation of everything that’s in your mom’s home? If you have access to the home, you might want to stop by and take pictures of everything. And we mean everything. Take pictures of the contents of every room, closet, bathroom, basement, storage area, garage, tool shed. Then, photograph the contents of every drawer, cabinet, and dresser so that have an image of everything in the home. You can also take a video for a different perspective in addition to photos. Digital pictures are cheap, so take as many as possible and from plenty of angles so that you have a good record of everything. The visual images will help you remember what should have been in the home in case some items start to disappear. You will also have a record of what your mom owned.

We also think you should talk to an attorney that concentrates their practice in elder law or probate matters. It might be worth paying for a couple of hours of their time to go through your photographs, offer options, and understand what steps you might want to take to protect your mother and any future inheritance, if you decide to confront your siblings.

There are several things for you to consider when it comes to hiring an attorney. The first is the actual cost to you in out-of-pocket expenses when you consult the attorney and they start doing work for you. The second is the impact hiring an attorney will have on the family dynamics. If it’s bad now, and we can sense relationships are already strained, it will be worse once you “lawyer up.”

Finally, understand the dollar cost to you if your siblings prevail in either buying the home or you fail to get your fair share from your mom’s estate. For example, if you miss out on $5,000, will it be worth it to you to either spend money on an attorney or let it go with the hope that your family relationships will improve? Conversely, if you might lose out on $200,000, then you might decide the money is worth fighting for.

While your mom is terminal, she isn’t dead. If she’s up to it, consider asking her (gently) what her intentions are and why she has set this plan in motion. If nothing else, you might gain some peace of mind that she has actively made her decision.

========

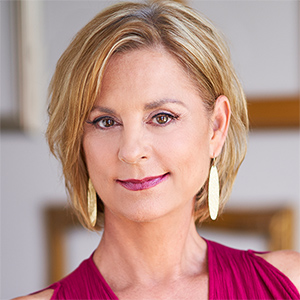

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask (4th Edition).” She writes the Love, Money + Real Estate Newsletter, available at Glink.Substack.com. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments