What are the tax implications of gifting a home?

Q: A friend is buying his parents’ home. He is using an online lender. He doesn’t have a real estate agent, and there is no written sales contract. The lender says his parents can gift him the house and the lender will then set up a refinance loan for him. Would the transfer of the home to my friend cause his parents to pay some type of tax to the IRS?

A: No. The transfer itself wouldn’t trigger immediate taxes for either the parents or your friend in the year the gift is made.

For 2025, the annual gift tax exclusion is $19,000 per person. This means each parent could give your friend $19,000 (for a total of $38,000) without any reporting requirements or tax consequences. Your friend would receive this money tax-free as well. The same principle applies to the home, except that we can assume the home’s value far exceeds $38,000.

When the gift exceeds the annual exclusion amount, the parents would be required to file Form 709 (United States Gift and Generation-Skipping Transfer Tax Return) with the IRS. You might wonder why the IRS cares about tracking these gifts if no tax is due immediately. The answer relates to estate taxes on wealthy individuals. The IRS wants to ensure that people don’t avoid estate taxes by simply giving away all their assets before they die.

The lifetime gift and estate tax exemption for 2025 is $13,990,000. This means the parents can give away up to this amount during their lifetime and at death before owing any federal estate or gift taxes. When the parents file Form 709 for the home gift, the IRS counts that gift against their lifetime exemption. Unless they’ve already given away close to $13,990,000 in assets, they won’t owe any gift tax now, but the amount will be tracked.

Here’s where your friend needs to think carefully about timing. There’s a crucial tax difference between receiving the home as a gift now versus inheriting it after the parents pass away. If your friend receives the home as a gift today, he takes on his parents’ original cost basis in the property. For example, if they purchased the home for $100,000 decades ago and it’s now worth $500,000, your friend would have a $100,000 basis. If he later sells the home for $500,000, he’d owe capital gains tax on the $400,000 profit.

In contrast, if your friend inherits the home after his parents die, he would receive a stepped-up basis equal to the home’s fair market value at the time of the last parent’s death. If the home is worth $1,000,000 at that time, your friend could sell it immediately for $1,000,000 with no capital gains tax liability whatsoever.

One potential offset exists if your friend currently lives in the home as his primary residence. If he’s lived there for at least two of the last five years, he can exclude $250,000 of gain ($500,000 if married) from capital gains tax when he sells.

We wish parents would think through these sorts of gift decisions, as they can have a substantial downstream impact for their heirs. We strongly recommend your friend and his parents consult with an estate planning attorney who understands the tax implications of these transactions before moving forward. The potential tax savings from proper planning could be significant.

========

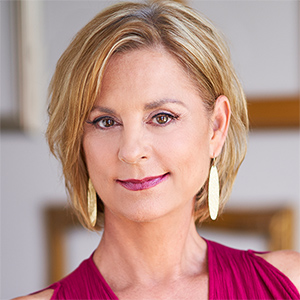

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask (4th Edition).” She writes the Love, Money + Real Estate Newsletter, available at Glink.Substack.com. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments