Editorial: Why Chicago hotels have a case for taxing themselves. And why we worry

Published in Op Eds

Anyone who has stayed in a hotel in a high-tax city like Seattle or New York is familiar with how that nightly $200 hotel room turns into $235 or more once numerous taxes are added.

Both U.S. states and cities from Omaha to Memphis love to smack visitors with high lodging tax rates, mostly because taxes that are not paid by locals are far less likely to receive scrutiny when elections come around.

Smarter minds, though, understand the nature of reciprocity and retaliation. We’re all nonlocals when we pay tax out of town and one increase sparks another. You may have noticed new fees for Americans to enter many countries as a tourist. They spread after the U.S. slapped fees on visitors.

Chicago already has a high hotel tax rate of 17.9% — No. 16 among the top 150 markets according to a comprehensive survey from HVS, a respected global consultancy in the lodging industry. That’s already far higher than Phoenix (12.57%), San Diego (12.50%) and Las Vegas (13.38%), at least in terms of the typical ad valorem taxes applied to room rates. These comparisons are complicated by the existence of flat fees per night in some cities, such as New York, which mean that cheaper hotels actually have higher effective tax rates there (something that would seem to go against the principles of New York’s new socialist mayor, Zohran Mamdani).

Some cities also have created special districts with their own taxes, often plowed back into the district itself or used for a convention hall or some other such tourism-related entity. That’s essentially what the city of Chicago’s tourism agency, Choose Chicago, is trying to push through City Hall.

Choose Chicago wants an additional 1.5% tacked onto guest bills of hotels with more than 100 rooms in the Central Business District, near McCormick Place and in the Illinois Medical District. During a recent meeting with us, board Chair Guy Chipparoni and recently appointed CEO Kristen Reynolds said that, after meeting with 3rd Ward Ald. Pat Dowell, they’d extended their target promotional zone farther south. This is Chicago, after all.

What would Choose Chicago do with the 1.5%? Fund itself, essentially. Currently, this destination marketing organization has about $33 million in annual revenue; with the new 1.5% tax — or “assessment” as they prefer to call it, being marketers — that revenue is projected to roughly double.

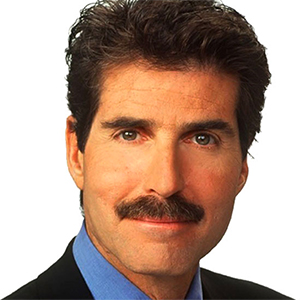

With an assist from Michael Jacobson, the all-in CEO of the Illinois Hotel & Lodging Association, the pair came armed with reasons we should support this new, ahem, tax.

Many were related to the importance of the tourism business to Chicago; we needed no convincing there, being long aware of the number of Chicago jobs (well over 100,000) tied to visitors. We’ve also long seen untapped tourism potential in Chicago, especially when it comes to European and South American tourists who tend to be infatuated with New York, Los Angeles and Orlando and could use an education on our city’s charms. We also believe that Chicago tourism has severely lagged other cities in post-pandemic recovery, especially when it comes to international visitors. We won’t bore you with all those statistics; any fool can see this is a vital industry to our toddlin’ town. And it needs a jump-start.

Choose Chicago’s other arguments for doubling its own budget (and maybe then some) involve the amount of promotional spending by competing cities. Las Vegas spends nearly half a billion dollars promoting itself each year and even after this new tax, Orlando still will spend more. As Chipparoni and Reynolds see it, this allows these competitors to steal business from Chicago, running promotions that Chicago cannot afford to duplicate and staffing offices Chicago cannot afford to open.

Chipparoni is a savvy player, and he knew he was speaking to a board that is no fan of raising taxes. So he emphasized that in this case, the hoteliers are “assessing” (LOL) themselves. The lodging folks see this as an altruistic act: Sure, their room rates go up with more visitors, but restaurants and theaters also get busier. If hotels are making this magnanimous gesture, their argument goes, they should rightly dictate how the new money gets spent. Ergo, the cash will come in and the hoteliers will oversee how it gets spent, as overseen by Choose Chicago.

We also sensed that the hoteliers quietly were implying that if they don’t raise this tax, there is a chance the city will decide to do so. And who might we better trust to ensure that the money goes to the right place? You likely can guess.

All in all, then, we think the hoteliers have a good case for their new taxing district and tax, which they say will be applied for five years, although the likelihood of it going away after that point is roughly akin to you getting an upgrade to the presidential suite, if there was one, at the Hampton Inn.

But it’s disingenuous to say that the hoteliers are the ones “paying” the assessment/tax. Certainly, in a competitive business, room rates greatly affect the choices of cash-strapped customers. But it’s the guests who are paying the bill, and in Chicago, they are not all from thousands of miles away, either. Plenty of suburbanites stayed downtown after the Sunday Bears thriller. Some Chicagoans need extra space on occasion for family or if their water pipes burst. There is shared sacrifice here.

We also wouldn’t want to see this become a Choose Chicago slush fund used, say, to double everyone’s salary. If they are going this way, rather than just writing checks, we think hoteliers must be transparent about where the money is going. They’ve promised the City Council and the media full audits and aldermen should insist on that; in the past, we’ve found Choose Chicago events heavy on the self-congratulations. If hotel taxes are rising, the city’s tourism agency should pivot to more frank annual meetings and ensure there are quantifiable results. (Our guests suggested an additional $3 billion in visitor spending in Chicago could flow from this initiative, turning $20 billion into $23 billion.)

In our view, that will also mean not just volume but more effective campaigns (with better slogans than past messaging) and focusing on areas where there are numerous attractions for visitors. We’d also like to see some of the money used for tourist-friendly improvements and co-promotions that would also benefit those of us who live here.

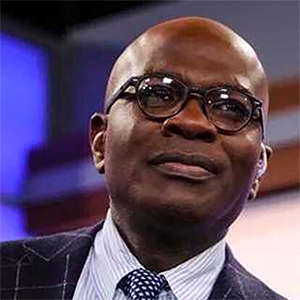

So, we endorse this request of the City Council. And we have a kicker. Our mayor constantly argues businesses don’t pay their fair share of taxes; this will hit many of them, especially during conventions. So there you go, Mayor Johnson.

_____

©2026 Chicago Tribune. Visit chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments