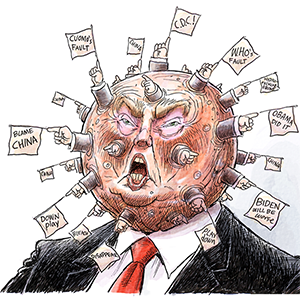

Trump's tariffs reshaped manufacturing in Asia. This time, the ramifications are even broader

Published in Political News

TAIPEI, Taiwan — The first time that President Donald Trump imposed tariffs on Chinese goods in 2018, it set off a scramble among manufacturers who had long relied on China to start looking for other options. The aim was to spur U.S. manufacturing, reduce a trade imbalance and punish China for trade practices Trump said were unfair.

Now, in his second term, Trump has hiked taxes on steel and aluminum imports to 25% and levied new 25% tariffs on Canada and Mexico imports, as well as an additional 10% tariff on Chinese goods. On March 24, he announced a 25% tariff on auto imports, and with his new plan for "reciprocal" tariffs to be announced Wednesday, other countries probably will be in his crosshairs as well.

After the 2018 levy, companies that produced their goods in China initially expanded into Asian countries such as Vietnam, Indonesia and India. But the current uncertainty surrounding trade policy has now turned planning into something of a guessing game that could reshape the landscape of global manufacturing.

The Times spoke with Robin Song, a China and Asia supply chain specialist with Kuehne+Nagel, a Swiss logistics company that advises clients on expanding their manufacturing operations, to ask about how companies operating in China might respond to the new tariffs. This conversation has been edited for length and clarity.

How did the 2018 trade war affect manufacturing in China?

The first wave hit appliances like refrigerators and washing machines, and mechanical and electric parts. Those companies started to establish factories in Thailand and Southeast Asia.

Next was renewable energy. The U.S. taxing goods like solar panels also motivated Chinese companies involved in renewable energy to expand their supply chain in Vietnam, Thailand and even Cambodia.

In the last several months of President Biden's administration, [U.S. officials] also put tariffs on goods out of Southeast Asia, which destroyed investment [there]. So solar panel companies suspended operations or maybe used that market to produce for alternative countries. And they actually listened to the U.S. government. Right now, the top leaders of solar panels are moving their production lines to the U.S.

What's the impact of the new trade war?

It's like catch-me-if-you-can. Some companies are moving their production into countries that are not on the anti-dumping or countervailing tax lists of the U.S. Some are moving to Indonesia. Saudi Arabia and the Middle East have also become very hot at the moment. Right now some guys are moving to Oman. Someone is also moving to Egypt.

China's dominance in EVs also prompted the U.S. to impose tariffs on electric cars. How has that affected the market?

For electric vehicles, with Europe putting taxes on Chinese EVs of 10% to 30%, one alternative example is Chinese automaker BYD building a factory in Hungary. We also see some joint ventures or acquisitions [by other Chinese EV companies] like Chery acquiring a former Nissan factory [in Spain] or Geely signing a joint venture with [French automaker] Renault. These partnerships are using legacy production sites or assets to produce EVs as a new model for collaboration.

For EV batteries, the trend is different. Indonesia has mineral resources like nickel. Morocco also has a lot of mineral resources. Hungary is also politically stable, so ... there's a lot of battery investment [in new factories].

Vietnam has been a popular alternative for manufacturers looking to expand outside China. Will that change?

There was very high anticipation that everyone was going to Vietnam.

But keep in mind there's still more than a $100-billion trade difference between the U.S. and Vietnam, and China is still the main export country to Vietnam. This means Vietnam has a trade deficit with China, and the U.S. has a trade deficit with Vietnam. The U.S. knows this loophole [for Chinese goods to reach the U.S.]. Vietnam building a stand-alone supply chain may be the only way to [satisfy] the U.S.

Some Taiwanese manufacturers are starting to shift some modules from mainland China to Vietnam as a trial. In case something happens which is unfavorable, they will just stop and shift again.

I didn't see a lot of big names invested in Vietnam, but they are pushing their upstream suppliers to invest instead. They say, 'I'll commit to this sales order to you, then you invest it,' which means everybody right now is leveraging their supply chain position — wholesalers, distributors, dealers — to push suppliers to move to Southeast Asia.

If someone tells me, "I have my supply chain diversified, I don't have only one source of export. I have Indonesia. I have Egypt," then this uncertainty comes down."

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments