Editorial: Democrats vote for higher taxes, government dependency

Published in Political News

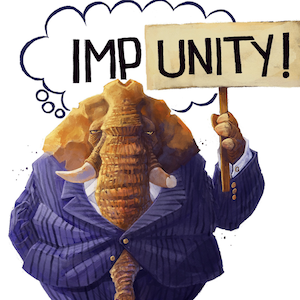

Republicans on Thursday shepherded President Donald Trump’s “big, beautiful bill” through the House, using their slim majority. Every Democrat voted against the legislation, preferring to support higher taxes on average Americans, a neutered national defense and government dependency among the able-bodied.

The omnibus proposal includes many useful provisions, including pay raises for members of the military, work requirements for food stamps and Medicaid recipients and financial backing for strengthening border enforcement. But the most notable provision is an extension of the 2017 tax cuts.

Allowing the tax relief to expire would create a drag on the economy and burden millions of Americans and their families who now pocket more of their own money than they did eight years ago. As economist Stephen Moore noted in The Wall Street Journal, history shows that tax increases stunt growth over time while tax cuts foster economic activity. Even a slight boost in annual GDP numbers thanks to the tax cuts will generate billions for Washington.

The House bill leaves the current income tax rates in place, despite calls from Democrats and others to increase taxation in the higher brackets. It also includes a temporary boost in the standard deduction, which will benefit filers of all incomes. The no-taxes-on tips proposal is included, a boon to thousands of Nevadans in the hospitality and other industries. Seniors, many of whom pay taxes on Social Security benefits, will be eligible for an even higher standard deduction.

The tax component boosts America’s small businesses by increasing the amount of qualified business income they may deduct from their tax bills. It also includes provisions to encourage business investment and productivity. These are all pro-growth measures that will pay dividends for the Treasury. To “pay for” some of these measures, the legislation reins in handouts for green special interests passed during the Biden administration.

To gain enough votes for House passage, Republican leaders agreed to increase the deduction for state and local taxes, a sop to profligate blue states that soak their own residents with higher levies. That’s unfortunate, but political reality necessitated compromise.

Critics site the “cost” of the bill, and it’s true that both Democrats and Republicans must start taking the debt and deficit seriously. But Washington has a spending problem, not a revenue shortage. Federal revenues have been remarkably consistent over the years, while spending has accelerated, particularly during the pandemic. Annual federal outlays now approach $7 trillion, double a decade ago.

The House has helped Trump deliver on his signature campaign promises. The Senate should now proceed with urgency to put the measure on the president’s desk.

©2025 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments