Bought a House -- Found Hidden Graves in the Yard

Reader Question: I just purchased a new home. It turns out the previous owners buried their parents in the yard and never disclosed it. They hung a plastic sheet in front of the gravesites so that I couldn't see the burial plot. I was told I need to sue and have the green light. How do I find a top lawyer who specializes in nondisclosure?

Monty's Answer: Few closings deliver a shock like discovering a family grave behind a vinyl curtain. Before racing to court, tighten the facts, weigh your real goals and identify every pocket that might pay.

No. 1: Secure Evidence Immediately

-- Photograph the graves, the plastic barrier and the yard from several angles.

-- Gather marketing pieces, seller disclosure forms, inspection reports, closing documents, texts and emails.

-- Write a day-by-day timeline while memories are fresh.

No. 2: Was a Real-Estate Agent Involved?

If you hired a buyer's agent, that brokerage carries errors-and-omissions insurance. Failure to notice a burial site or to question a vague disclosure can trigger a claim and enlarge your negotiating pool. If you bought directly from the seller, this safety net is absent, and recovery rests on the seller's homeowner policy and personal assets.

No. 3: Did Anyone Inspect?

A professional inspector should note any headstones or unusual landscaping features. If no inspection occurred, your damages case weakens. If an inspector missed obvious signs, add that company (and its insurer) to the demand letter.

No. 4: Clarify Your Desired Outcome

----

Decide whether you want:

a) Disinterment and yard restoration, which are often difficult and slow.

b) Monetary damages for loss in value.

c) Rescission -- unwinding the sale and recovering your funds. Knowing the target helps a lawyer frame the claim and gauge the cost-benefit.

No. 5: Explore Low-Cost Options First

-- Talk with the sellers. Some families, embarrassed when confronted with photos and statutes, will pay voluntarily for landscaping, memorial markers or a price adjustment.

-- Mediation. Real-estate mediators, often retired judges or lawyers, can convene buyers, sellers and agents in one room. Fees range from $750 to $2,000, and most disputes are settled in a day or two, saving months and tens of thousands of dollars in legal costs. Vet mediators for recent disclosure cases and require written confidentiality.

-- Arbitration or Suit. If the early steps fail, litigation remains an option. Mark the two-year (in most states) statute-of-limitations date on your calendar.

No. 6: Finding the Right Lawyer

Seek a real-estate litigator experienced in seller-fraud or failure-to-disclose cases:

-- State bar referral panels under "Real Estate Litigation."

-- Title company claims counsel -- they track who wins.

-- Martindale.com filters for peer-reviewed lawyers.

-- Interview at least three firms. Ask about recent verdicts or settlements, fee structure (hourly versus contingency), projected discovery costs and willingness to include the listing agent, broker, inspector or sellers' insurer as additional defendants.

No. 7: Budget Realistically

Disclosure suits often cost between $15,000 and $60,000 to reach trial. Some lawyers advance expenses and receive 30 to 40% of the recovery; others use a retainer. Insist on phased budgets and explore coverage under your own title or homeowner policy.

The Objective: Preserve evidence, confirm whether an agent or inspector adds an insured defendant and exhaust direct negotiation and mediation before committing to a lawsuit. With clear objectives and the proper professional support, you can convert a grim surprise into a fair outcome and enjoy the home you thought you were buying.

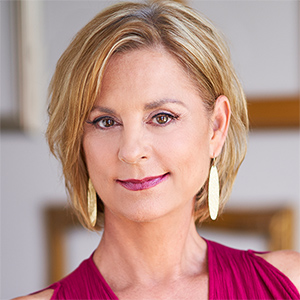

Richard Montgomery is a syndicated columnist, published author, retired real estate executive, serial entrepreneur and the founder of DearMonty.com and PropBox, Inc. He provides consumers with options to real estate issues. Follow him on Twitter (X) @montgomRM or DearMonty.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments