Lender required homebuyer’s parent to prove down payment contribution was gifted rather than loaned

Q: When I gave my son some money to buy a house, I had to submit a letter to his lender stating that the money I gave him was a gift and not a loan. Why did the lender require that?

A: As housing has become more expensive and the newer generations need a larger amount of money for a down payment, homebuyers often seek financial assistance from relatives or friends. Usually it falls on parents or close relatives to help out. We rarely see friends give down payment assistance to other friends. Sometimes, first-time buyers qualify for down payment assistance programs, though those usually have income limitations or location restrictions.

Lenders need to understand how much money a prospective homebuyer has in the bank, how much they earn, what they owe and what it will cost them to own a home. They want to have an understanding of what the buyer’s monthly debt service looks like. And, they’ll require the buyer to have at least three months’ worth of mortgage, taxes, and insurance payments in the bank.

Since first-time buyers typically max out what they can afford, lenders don’t want to see debts to relatives on top of what the lender is lending to the buyer. Lenders don’t want any confusion over which debt has to be repaid first. And, they don’t want the buyer struggling to make payments.

Think of it this way, if your son buys a home for $100,000 and needs a $20,000 down payment, he might have $10,000 in cash but needs another $10,000 to get to 20% of the purchase price. (If you have 20% to put down, you’ll qualify for better loan programs with the lowest interest rates and the lowest fees.)

When the lender looks at how much your son earns, what he owes in student loans or credit cards, and what his anticipated homeownership expenses will be, the lender will make a decision about how much cash to lend to cover the purchase.

If you give your son a loan for $10,000, the lender then has to treat that amount of money as debt when calculating how much to lend. In many cases, that debt will throw off the prospective borrower’s debt-to-income ratio. This is one of the main reasons lenders don’t want to see money going from a parent to a child being labeled as debt. If the $10,000 is given as a gift, and you write a gift letter stating that the money does not need to be repaid, the lender will ignore that for purposes of their debt-to-income ratios.

Money that is lent between a parent and child, for example, but dressed up as a gift, can cause problems down the line. It’s easy for a buyer to lose their financial balance and the property would wind up in foreclosure.

If you’re able to give these funds as a gift, and write a letter to that effect, then the buyer’s finances become a known quantity for the lender. Lots of parents give kids a financial gift to help with a down payment. They know how to account for it.

If you write a gift letter, then you wouldn’t have the legal right to go after your son to repay the funds you gave him. But in 2025, anyone can give a cash gift of up to $19,000 to another individual. So if your son decides to repay your largesse down the line, it won’t be an issue for the lender.

========

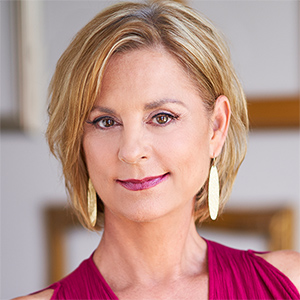

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments