Readers seeks clarification regarding enforcement of due-on-sale clause

Q: The Garn-St. Germain Act prohibits enforcement of a due-on-sale clause in a transfer where the spouse or children of the borrower become an owner of the property. Does the “transfer” mean inherit, or does it also include “sale” where the deceased and the spouse are tenants in common?

A: Congress passed the Garn-St. Germain Act back in 1982. One of the provisions of the Act was to prohibit lenders from exercising their due-on-sale rights when a homeowner passed away and the home was inherited by one of the deceased owners’ children or a spouse. It also allowed for the transfer of the home to living trusts and transfers between ex-spouses as a result of a divorce.

Prior to the passage of the legislation, when you purchased a home, the loan documents contained a clause that basically stated that if you transfer your ownership in the home without the lender’s permission, the lender has the right, but not the obligation, to call the loan and request the repayment in full.

To avoid situations where there are life-changing circumstances, the Garn-St. Germain Act alleviates some issues where the home goes to the kids, the spouse or where an owner wants to put their home into a living trust for estate planning purposes.

You mentioned that the owners of the home you are concerned about own the home as tenants in common. This means that when one owner dies, the other owner does not automatically inherit the deceased owner’s interest in the home. If they owned the home as joint tenants with rights of survivorship, the surviving owner gets the home automatically upon the death of the co-owner.

So, if you mean if the deceased owner’s share of the home can go to anyone, the Garn-St. Germain Act would not protect that transfer. But if the deceased owner’s share of the home would go to the widow or kids, then the lender shouldn’t be able to call the loan, even if the widow or kids paid for the interest in the home they were taking over.

On the other hand, if your question implies that the widow and the heirs intend to sell the home to a stranger, the lender could call the loan in that situation. These days, interest rates are around 7% for a 30-year loan. It was only a couple of years ago that interest rates were around 2.5%.

Many homebuyers would love to buy a home and take over a low interest rate loan. To do that, the prospective homebuyer should work with the seller’s lender to see if they can assume that loan. Some loans are assumable. Those loans issued by the Federal Housing Administration (FHA) are assumable, but the prospective buyer must go through the process of getting approved, and a fee is paid to the lender for that assumption.

Most other loans are not assumable. You can contact your current lender and find out if they allow assumptions, but we suspect you’ll be told that the loan is yours and that your prospective buyer must get their own loan.

If our readers are finding out that non-FHA lenders are agreeing to loan assumptions, please let us know. Finally, we have some information about FHA loans and assumable loans on the ThinkGlink.com website you might find helpful. Thanks for your question.

========

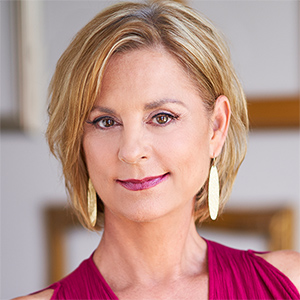

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments